It’s official – Ulster Bank is leaving Ireland. One positive effect of the news is that it’s prompting customers to think about what to do with lump sums sitting in cash in the bank.

Since you’ll have to move your cash out of Ulster Bank anyway, here are five good reasons to consider investing it in funds for growth.

1. Cash has been going nowhere for a long time

Savers have experienced over a decade-long drought in interest rates – and that’s not likely to change anytime soon.

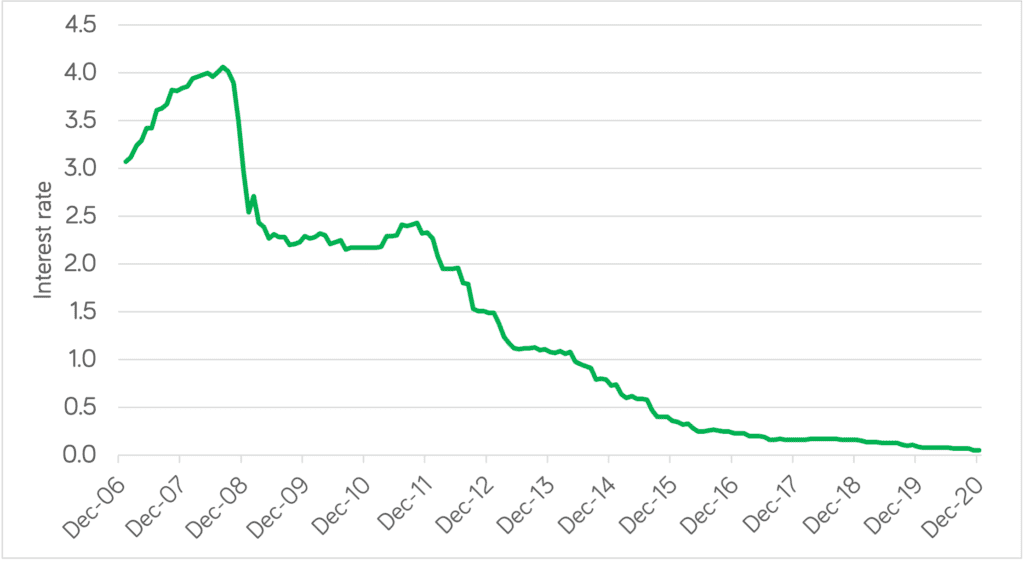

Here’s a chart using Central Bank of Ireland data on the interest rates paid on notice accounts in Ireland since 2007.

And the efforts of governments to deal with the effects of coronavirus mean interest rates are likely to remain low for the foreseeable future.

2. Decent returns are available elsewhere

But not all money is sitting doing nothing.

Over the same period, investment funds have steadily grown investors’ money.

For example, Irish-based funds generated an average 8.2% annual return in the five years to February 2021 (based on data from Rubicon).

3. Rising inflation is likely to erode the value of cash

In response to coronavirus-induced lockdowns, governments and central banks worldwide have flooded economies with handouts. There’s a huge amount of pent-up demand, and cash to spend.

At the same time, supply is being reduced. That’s a recipe for inflation.

Take airlines for example. Just imagine the demand for flights abroad once we’re finally free to fly again. Then realise that more than 40 airlines went bankrupt last year.

Fewer seats and rising demand will only push up prices.

Inflation reduces the value of your cash – a key reason for investing in assets that have scope to grow.

4. It’s not all about cash and property

We Irish tend to hoard cash and property. But other assets are available!

Take a look at your overall wealth. If you’re like many people in Ireland, the bulk of your wealth is tied up in residential property, the price of which is closely connected to the performance of a rather small island economy.

Investing some of your cash is a great way to broaden your exposure to growth from other geographies (like the US and Asia), industries (like tech and healthcare), and asset classes (from company shares to bonds, commodities and alternative assets).

5. Withdraw any time

In the past, it was common in Ireland to be penalised if you sought to take your money out from an investment in the early years, with ‘early exit fees’ charged on a percentage of the value of your funds.

But it’s your money!

These days, holding money in a liquid investment fund is more accessible. You can start with a lump sum, and add to it monthly.

At Moneycube, we don’t recommend investing for fewer than three years. But we still believe you should be able to access your money anytime. This last year has shown us all how quickly our circumstances can change.

What’s holding you back? Make a start today!

You must be logged in to post a comment.