Moneycube believes we should all take control of our money.

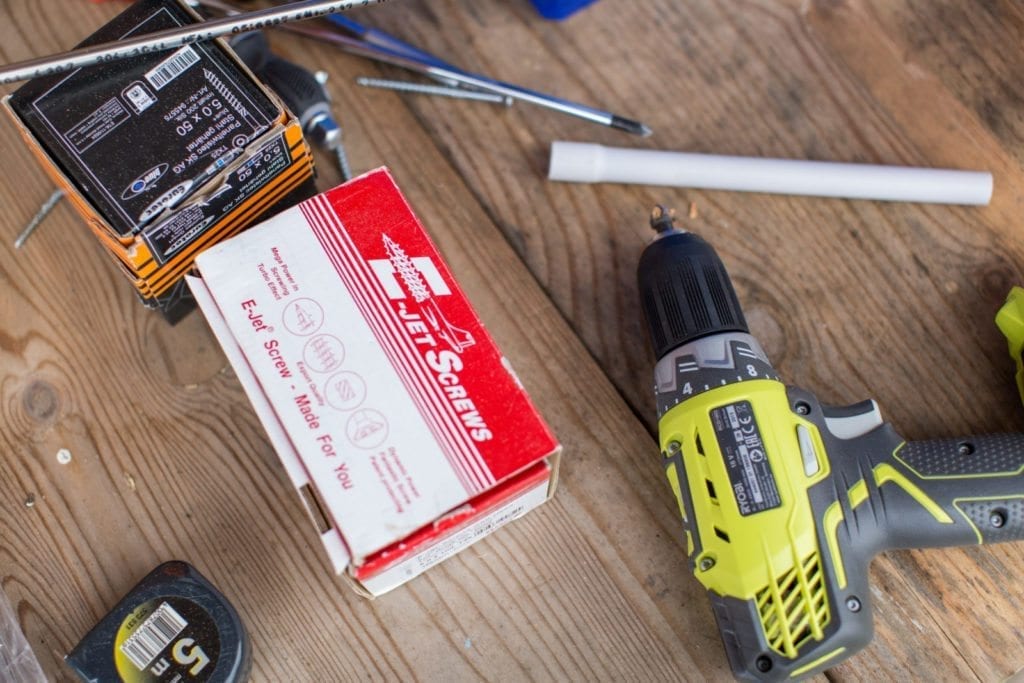

But that doesn’t mean you should do everything yourself. Putting your investment plans together isn’t as easy as assembling a flat-pack (and even that gets complicated).

Here are some reasons to think twice before getting your financial overalls on, and to consider web-based financial advice instead.

What is DIY investing?

DIY investing is when you choose and manage your own portfolio of investments (typically shares). Just like assembling your own furniture, the theory goes that you can save money by dealing direct.

In practice, things aren’t so simple. Here’s why.

Timing is everything

DIY investors are often late to the party. There is evidence that DIY investors frequently buy into stocks that have had a good recent performance… only to find that they are fully valued.

DIY investors therefore miss out on valuable periods of really strong growth.

On top of that, DIY investors have a habit of selling too fast when markets go down. By contrast, institutional investors are more likely to grit their teeth and benefit from the uptick that often follows.

There is such a thing as being too close to your money.

Diversification needs scale

As a DIY investor, it’s difficult to build and manage a sufficiently diverse investment portfolio.

Most professional investment portfolios will have anything from 20 to hundreds of investment positions. That gives your portfolio exposure to a great variety of asset types, geographies, and industries. This de-risks your money, as you avoid heavy exposure to any single company, sector, or region.

As a DIY investor, it is no easy task to replicate a similar level of diversification.

Managing a portfolio is a full-time job

Even if you do choose enough investments to diversify adequately, managing them day-to-day will eat up a lot of your time.

Can you be confident that the risk in your portfolio has stayed at the level you intended?

Is it time to rebalance (ie buy and sell some assets to return to the original weightings you chose)?

Limited or non-existent cost savings

Especially if you value your time, the cost savings from DIY investing are non-existent.

UK research suggests DIY investors underperform the market by about 1.2% per year – more than enough to pay a financial advisor and pocket some change.

As a retail investor you are likely to pay higher transaction costs. You’ll also be on the hook for stamp duty on your direct holdings in shares (1% for Irish shares, 0.5% for UK shares), and tax on capital gains each time you rebalance.

DIY investing vs the Moneycube alternative

While DIY investing has its dangers, we still think customers should stay in control of their money. That’s why Moneycube’s investment process focuses on helping you understand your investment priorities, risk/ reward tolerance, and timescale.

We then partner with you to translate that into the right fund investments for you.

Our customers get the advantages of professional portfolio management, diversification, strong risk management and competitive cost. It’s Do-it-together, not Do-it-yourself.

Get started with Moneycube today.