There have been some dramatic changes in financial markets – and the world in general – over the last six months. As we approach the half-year market, it’s time to look at what has happened, how things are likely to unfold in the second half of 2022, and what it means for your investments and pensions.

H1 2022: the reversal

It’s a statement of the obvious to say that the first half of 2022 has been a difficult one in financial markets. In fact equities markets are on track for their worst first six months in at least half a century.

And other asset classes have been badly hit at the same time. Bond prices have been pushed down significantly by rising interest rates. Cash continued to lose its purchasing power through inflation. Cryptocurrencies – touted by some as exempt from the rules of the market – have been one of the worst-hit sectors.

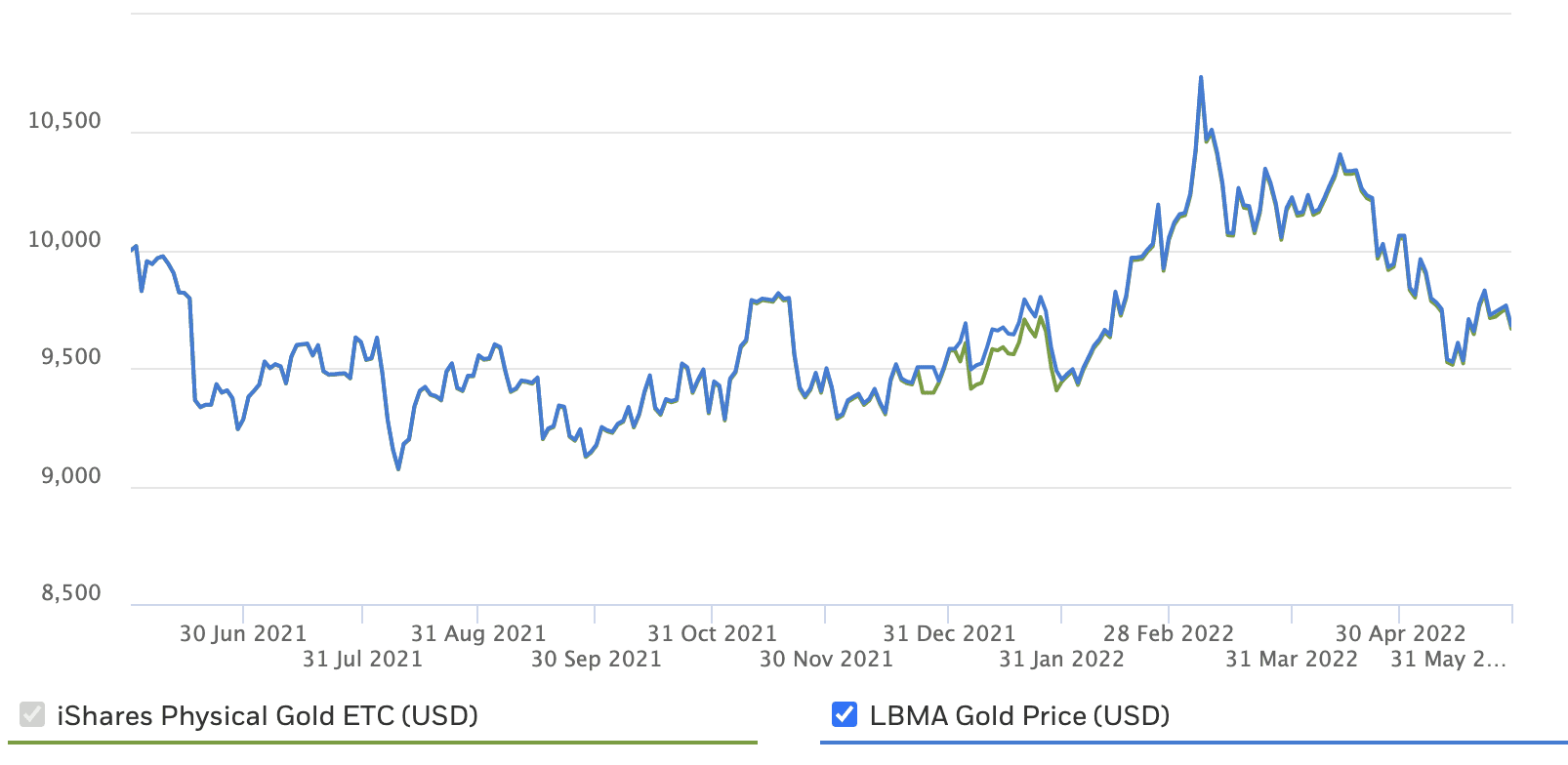

Even gold, traditionally a safe haven in adverse times, is down over 3% (in US dollar terms) in the 12 months to 31 May 2022.

Source: iShares.com

That means that even those with highly diversified portfolios have endured significant paper losses.

It was possible to deliver investment growth in the last six months, but you’d have needed major holdings in the areas of defence, energy, and commodities – which are generally niche positions for most investors.

Two factors have driven global financial markets in the first half of 2022: the Russian invasion of Ukraine, and the rise of inflation.

Central banks: rushing to catch up

Despite the horror of war in Europe, inflation has had a bigger effect on global markets over recent months.

Having held to the view that inflation was a short-term blip for too long, in 2022 central banks have rushed to try and damp it by raising interest rates. On 15 June, the US Federal Reserve announced a raise in rates of 0.75%, its largest single rise since 1994.

What’s the outlook from here?

Our view is that the worst of the repricing we have seen in recent months is behind us. However, markets will continue to be more volatile than usual until we see clear evidence that inflation is being tamed.

That will happen, but it is likely to be towards the end of the summer at the earliest. Until then, you can expect higher than normal daily movements in asset prices – both up and down.

The positive side to this is that central bankers now seem determined to get a grip on inflation – without delay. One member of the rate-setting committee has said “The Fed is ‘all in’ on re-establishing price stability”.

A rate rise cycle that was initially expected to take a couple of years looks set to get done within the next few months.

Once that is behind us, there are prospects for a sustained recovery in asset prices.

The risk to this outcome is that interest rate rises could trigger a global recession. Although rate rises, war in Europe and slowdown in China are raising that risk, as matters stand this looks unlikely this year.

Consumer demand remains strong, employment is high, and household and company debt is relatively low, having been paid down in the long months of lockdown.

In fact, while it might be a bumpy ride, by comparison with other major asset classes, equities look to have scope to grow, following the repricing in the first half of the year. That’s when you compare the potential for equity returns with bonds in a rising interest rate environment, challenging valuations on property, and cash which still pays zero interest to Ireland-based investors in a high-inflation environment.

There are good reasons, therefore, to believe that equity markets will stabilise and recover in the latter months of 2022.

Should you take action?

Investors have three broad options in adverse markets:

(a) adjust to less volatile assets or cash,

(b) increase holdings, or

(c) stick to your existing positions.

There is much evidence that option (a) tends to reduce wealth as paper losses are made permanent, and recoveries in value can happen rapidly once the corner turns. The S&P 500 rose by more than 6% in the week of 20-24 June, for example.

Option (b) is a possibility for those who are hunting for value, but is not for the faint-hearted. It needs to be done in a measured way because it is impossible to call the bottom of the market, or know the best timing to invest for the recovery in prices when comes.

That’s why option (c) is generally the right choice for long-term investors. If you invest with Moneycube, your money is held in an investment fund (or several) which is highly diversified, and holds a wide range of assets in line with your risk-reward appetite and investment timescale.

Wherever you invest, if you hold a broad range of investments in professionally run companies which are managing their business for profit and cash generation over the medium and long term.

It is likely to be continue to be uncomfortable in the short term, but there is every reason to believe these funds will recover as your fund managers do their work and confidence returns to the market.