Compounding is about getting interest on your interest, rather than just on your original money. Over time, this has a massive effect on the growth of your savings. And investment funds are a great way to get compounding to work for you. Here’s why.

The maths is in your favour

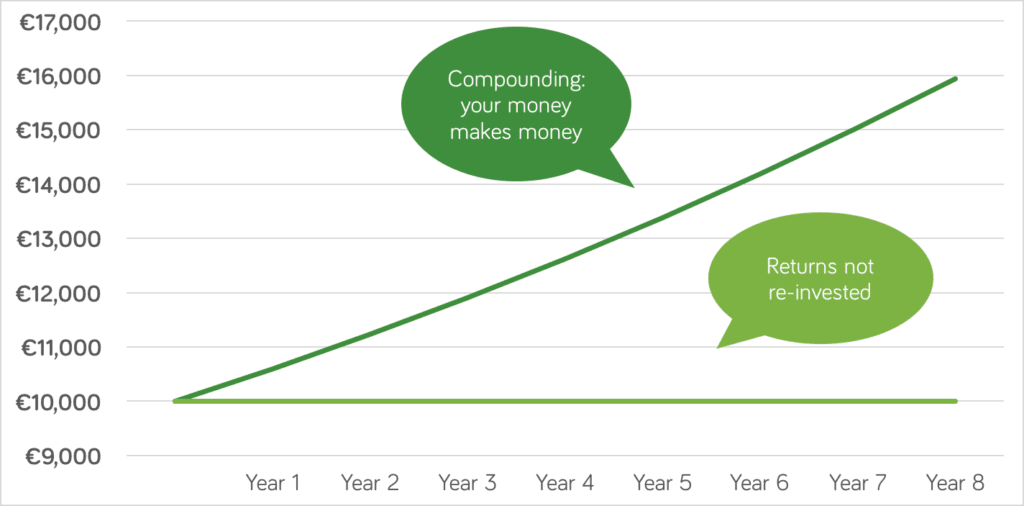

Take an example of €10,000 invested for 8 years. Assuming a 6% growth rate, you’d earn €600 in the first year on this money. If you took that money out, you’d earn the same amount in year 2. But if you leave the money alone, your additional €600 gets to work and earns you an additional €36 in year 2. (We’ve adapted this from Vanguard’s useful example).

After 8 years, your investment would be worth nearly €16,000, compared to the €14,800 you’d have if you took out your €600 earnings each year. That’s a 24% higher return.

Your money stays in the pot

The key here is to give your money time to grow. If your money goes into an investment fund, and stays there, all the interest, dividends and capital gains produced by the underlying investments pile up within your pot. Your money grows faster and faster as time passes.

Tax is only taken at exit point

Under the Irish regime for investment funds, tax is charged only on exit, or 8 years after the original investment. That helps, because the money which stays in the pot can continue to earn a return for you. By contrast, in a bank account, the tax on your interest is deducted straightaway.

It’s even better with pensions

The longer your let your money compound, the more it benefits you. Take the same €10,000 initial investment in the context of a pension investment timescale. Growing at 6% per year over a 40-year period, you would have a sum in excess of €100,000.

Get started with Moneycube today