Our favourite technology fund for investors based in Ireland might seem an unusual choice – for several reasons.

To start with, it’s not a pure tech fund. Secondly, it’s not new – in fact the fund has been around for over 110 years. And it certainly doesn’t sound techie: it’s called Scottish Mortgage Investment Trust plc.

So why do we like it so much?

It’s Scottish Mortgage’s combination of performance, principled investing decisions, global outlook, and low fees that make it one of the best technology funds available in Ireland.

Great long-term performance

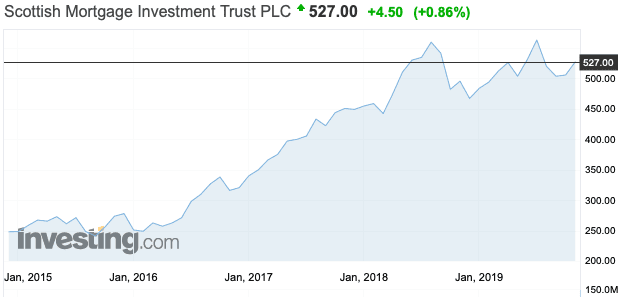

Firstly, it’s hard to gainsay the performance Scottish Mortgage has turned in. Over the ten years to the end of October 2019, its share price is up 492.4%.

For comparison, the FTSE All World index is up 212%.

Growth over the last five years isn’t bad either, more than doubling your money at 116.8%, as the chart shows.

Put simply, if you had invested €25,000 in November 2009, you’d be sitting on over €148,000 today.

What’s more, investors have received dividends over that time, further boosting returns.

High-conviction investment strategy

The managers of Scottish Mortgage Investment Trust, Edinburgh’s Baillie Gifford, are focused on the long term.

In particular, they aim to pick out trends that will drive transformational future growth. So we are looking a broad definition of technology (in fact, Ballie Gifford dislike technology as a fund description).

For example, Scottish Mortgage sees huge potential in businesses that have truly understood the power of networks. Yes, that means Amazon, Tencent and Microsoft – but also Grubhub in the food industry, and Gucci in luxury goods.

Scottish Mortgage’s second-largest holding is in Illumina, a biotech/ gene sequencing company.

Other major holdings include Alibaba, Alphabet, Ant Financial, Netflix, Nvidia, and Spotify.

And as WeWork’s problems in autumn 2019 have shown, it pays to look a little deeper at Silicon Valley businesses before assuming they can all grow exponentially.

So while Scottish Mortgage holds many of the big names in tech, it’s not afraid to back less well-known disruptors too.

A global outlook

Technology isn’t held back by geographic boundaries. And neither is this fund.

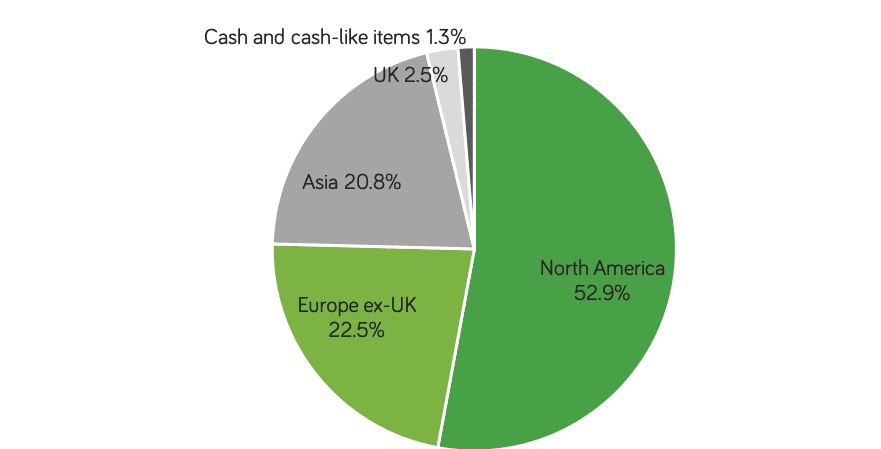

Firstly, even though it’s a UK fund, just 2.5% of its total assets are invested in UK companies. North America is the lion’s share, with Europe and Asia making up just under half the total assets.

For an Irish investor, investment access to tech and transformational companies – wherever they are in the world – is invaluable.

Fund management costs are kept low

One of Scottish Mortgage’s strengths is the effort it makes to keep costs down.

Because it’s such a large fund (valued at over £7.5 billion), management costs are spread over a very broad base.

And the managers don’t indulge in rapid-fire trading. As befits a long-term manager, the approach for many of the investments is to buy and hold, keeping trading costs down.

You can access Scottish Mortgage Investment Trust for lump sums as part of Moneycube’s advice service for an all-in annual cost of 1.27%.

So what’s not to like?

As the fund’s board of directors say themselves, “Scottish Mortgage is not intended to be all things to all people, and is most suited to those who share its patient, long term approach to investment”.

Technology investment can deliver great growth – but it can also be a bumpy ride. Growth over the last 12 months has been more modest, at 5.5%.

For many investors, a little of this fund will go a long way, delivering great growth potential, in a mix with other funds to offer wealth preservation and exposure to many other industries.

Talk to Moneycube or let us know your requirements online if you’d like to put together a balanced portfolio to reflect your requirements.

Notes:

Investment growth and asset split figures given in GBP.

Performance figures are for the period to 31 October 2019, except chart which is to 25 November 2019.