Each year, we pick a handful of investment funds available to Irish investors and highlight them on our blog. We’ve charted below how our 2023 selections performed.

Interested in our 2024 picks? Click here to read more.

2023 was a tricky year to have your money in investment funds. Equity markets were up 18.1% in Euro terms (measured by the MSCI All-Country World Index).

But that large rise hid much variance in performance, both among individual funds, and through the year itself. Along the way, equity investors had to tolerate falls of more than 6% during February and March, 4% during July and August, and 7% during September and October. As we said at the start of the year:

While growth is out there in 2023, volatility hasn’t gone away. There will still be significant moves in major markets on a day-to-day basis.

It’s a time to invest in a measured way, taking steps to manage short-term volatility, rather than place big bets on any single trend.

It’s a reminder that investing’s a long-term game, and no fund will get it right all of the time.

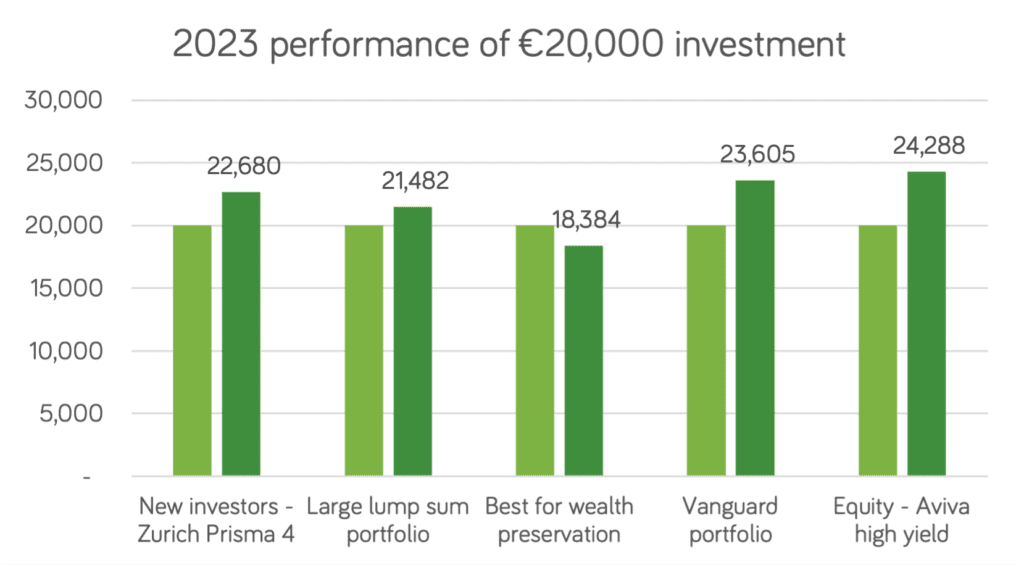

We’ve set out the one-year performance of the funds we recommended at the start of the year in the charts below.

We didn’t get them all right – our wealth preservation choice, Ruffer Investment Company, lost considerably; caught out by losses in long bonds, and a failure of planned offsetting trades within the portfolio to provide the balance and smooth performance Ruffer has offered in the past.

Of course, the reality plays out differently, as this fund is only ever one of several in an investment portfolio at Moneycube.

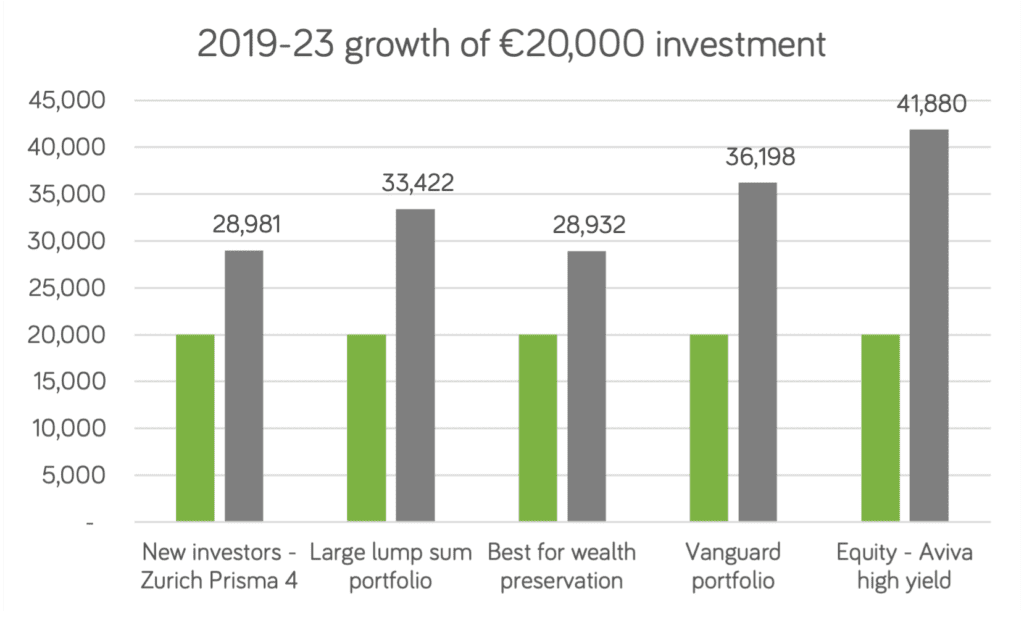

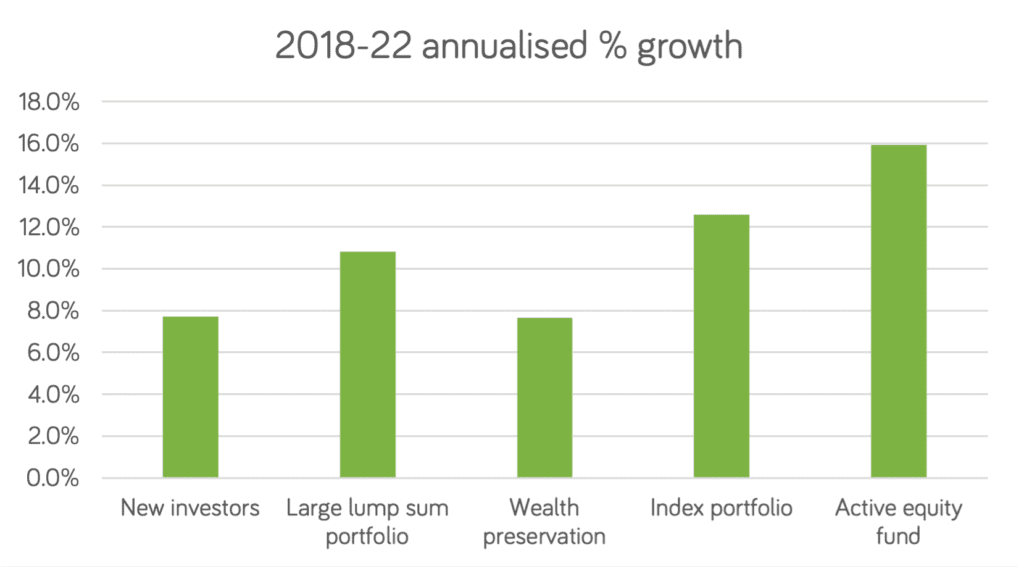

And secondly, it’s the longer term that really counts. We’ve charted the five-year performance of our 2022 chosen funds below. And over that time, Ruffer has delivered much more reliable returns.

As you can see, they have all turned in solid long-term growth. Even the lowest performer here is up over 7.7% over five years. Compare that to five years of rock-bottom interest rates in the bank!

You must be logged in to post a comment.