Welcome to Moneycube’s annual roundup of the best investments available in Ireland.

Jan 2025 update: Our more recent post highlights the best investment opportunities for your money in 2025.

We’ve chosen five funds we think have strong potential for the year ahead in the wake of tricky 2023, and a promising start to 2024. If you’re looking to invest money in Ireland, read on.

Whether you’re a new investor, or looking to invest a large lump sum, we’ve got a fund for you.

We’ve also crunched the numbers to identify our two favourite global equities funds for Ireland-based investors in 2024.

Remember, these funds are all available through our online platform, along with many more. But a word of warning at the start: everyone’s circumstances are different. We’d love to hear about your detailed requirements and advise you on what’s appropriate for your situation.

Three themes for the year ahead

In our market outlook for 2024, we highlighted three themes investors can expect in the year ahead:

- A search for quality and hard results over promises in equities

- The iron rule of bond prices asserting itself as interest rates fall, and

- The intrusion of politics into the economic sphere as elections and conflict continue to dominate through the year.

There’s plenty to trip you up – yet lots of opportunity out there too. As ever, if you invest in a diversified and measured way – as Moneycube customers do – there will be significant opportunities for investment growth.

Finally, there’s also a need to stay the course. Investing’s a long-term game. So we’ve shared some ideas on equity funds for the long term – perhaps via a regular monthly investment.

This might all sound great in theory, but how does it look in practice? We’ve taken a look at how €20,000 invested a year ago in our 2023 selections performed here.

In fact, you’ll find there’s a quite a lot of continuity between our 2023 choices (and our 2022 choices), and this year’s. That’s just as it should be, because investing’s a long term game. At the same time, we’ve also introduced some new funds which have proven their worth in the new economic environment we’re in.

Remember, these funds are all available through our online platform, along with many more. We can help you put in place lump sum and regular investments, big or small, to start growing your wealth today.

Best fund for new investors

Moneycube believes multi-asset funds should lie at the centre of most investors’ portfolios.

Whether you are investing a lump sum, setting up a regular investment, or both, multi-asset funds are useful. In a single fund, you can achieve the diversification, flexibility and balanced growth potential that most people need from their wealth.

For new investors, we’re sticking with a long-standing choice. Zurich’s Prisma range is a strong option for many who want to invest money in Ireland. We’ll focus on Prisma 4 here, as it’s a balanced, mid-risk fund suitable for many investors.

Prisma 4 had an excellent 2023: it grew by 13.5%.

It gives exposure to a broad range of assets, split among equites (44%), bonds (41%), alternative assets including gold and commodities (7%), and property (4%).

Prisma 4 is also spread over the globe. 71% of the fund is invested in the US and Canada, just 14% in Europe, 6% in Japan, and 4% in Asia-Pacific.

As we enter the year, the level of equity within the fund has reduced by 9% versus a year ago, shifting most of the money into bonds. And one of the big prospects for growth this year is a recovery in the bond market, so Prisma 4 offers strong prospects.

More importantly, it has a long-term track record of on-track returns, delivering on average 6.6% since its launch ten years ago.

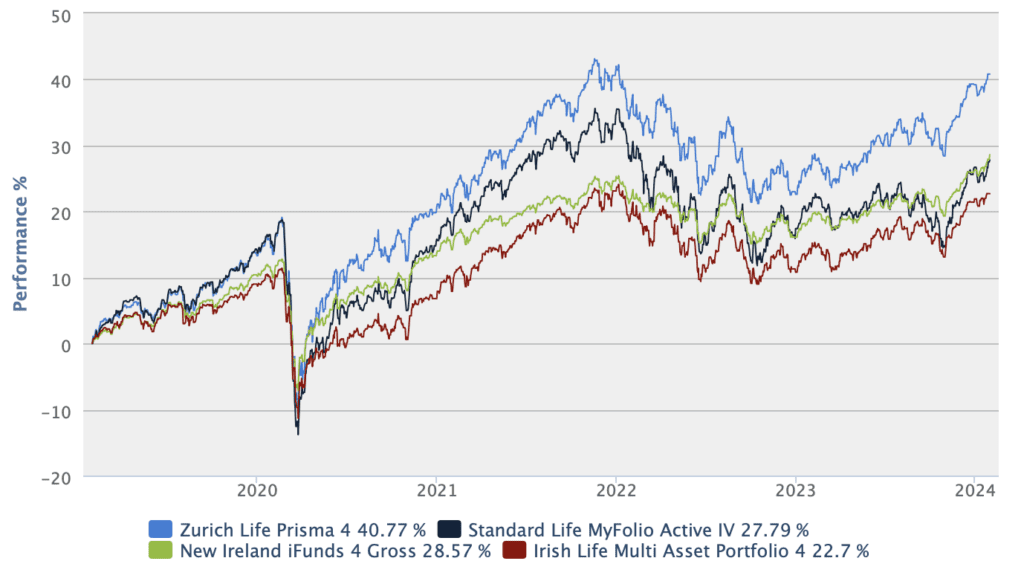

In the last five years (to January 2024), this fund has returned 40.8% total growth as this chart shows.

In fact, Zurich Prisma 4’s performance is substantially better than comparable funds from its competitors at Irish Life, New Ireland, and Standard Life over the last three and the last five years.

Here’s a comparison:

Source: Longboat Analytics

For contrast, your money in the bank has earned less than 0.5% in interest during the same period.

As a second contender, it’s worth considering Aviva’s index-based Fixed ESG range. This fund launched in mid-2022 and now has some performance track record. Their Fixed ESG 60 fund – the nearest comparison to Prisma 4 – grew 13.2% last year.

While these funds aim to track the performance of global indices, they are overweight towards exposures which have higher ESG ratings. That proved a benefit during 2023, for example, as energy stocks slid.

Aviva’s index-based approach also means this fund range tends to be around 0.1% lower cost than many comparable rivals.

Best fund for larger lump sums

If you have a lump sum of around €50,000 or higher, it’s time to consider using Moneycube to build your own portfolio.

If you’re willing to handle your own tax affairs, you can open a much wider world of fund options, and significantly drive down your overall cost of investing.

We generally recommend a portfolio of at least five such funds. So it’s hard to pick a single fund in this category.

We build our portfolios to give an appropriate spread of global diversification, wealth preservation, and growth equity.

With this approach, you can introduce specialist exposures to specific regions or industries. One fund whose prospect we like for 2024 is the Scottish American Investment Company – also known as Saints.

This fund, which marked its 150th anniversary last year, holds a range of global equities, and a small amount of other assets including property. Its largest holding is Novo Nordisk, the Danish company which is pioneering diabetes and weight-loss treatments with its Ozempic and Wegovy drugs. This stock alone grew 49% in 2023.

The fund also holds many global businesses with strong brand names, solid dividends, and the prospect of reasonable equity growth, such as Procter and Gamble, PepsiCo, and L’Oréal.

Saints also boasts consistency: it has raised its dividend every year for the last half-century.

You can read more about our approach to investing larger lump sums here.

Two of the best pure equity funds for long-term investors

Long-term investors can afford ride out short-term market dips. That means they can take more risk with their money, to create the potential for better growth. We’ve selected two funds to fit this bill. As it’s long term – and the returns speak for themselves, these are funds we’ve looked at in the past.

One is actively managed in Dublin. The other is a pure passive solution from global leaders Vanguard.

Index investing with Vanguard

If you simply want a slice of what is going on in companies all around the world, a ready-made portfolio from Vanguard might be for you. Using this route, we’ll help you invest into four index funds, giving you exposure to the US S&P 500, and major European, Japanese, and emerging market stocks.

It’s hard to beat this approach for diversification among companies. Taken together, this portfolio holds positions in over 2,700 companies. And it has delivered average annual growth of 10.7% over the last ten years.

You can read all about Vanguard and index fund investing here.

Active management with Aviva Investors

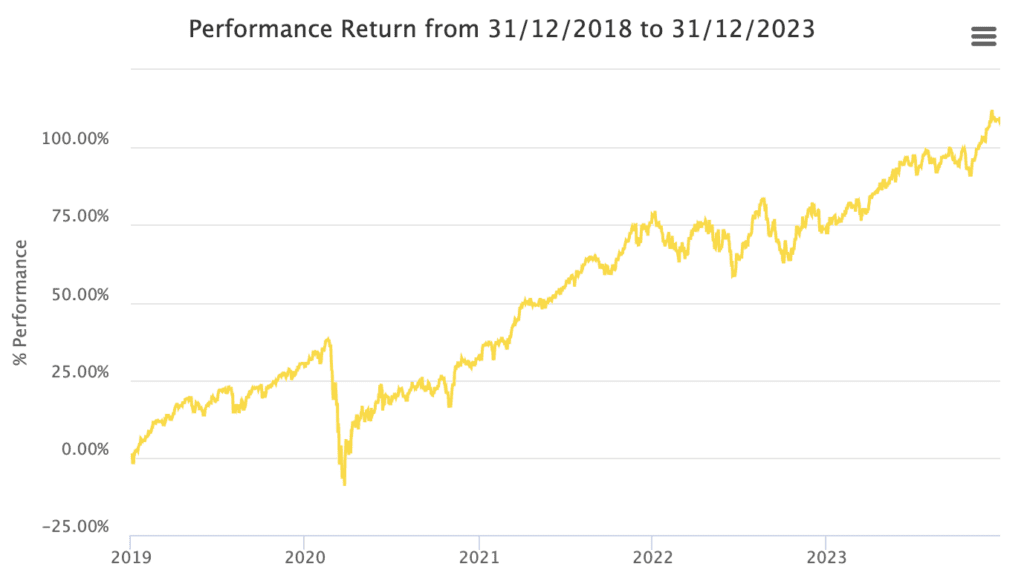

If you’re contemplating investing a large lump sum there are also a number of funds which have proven their ability to deliver in many different market conditions through active stockpicking. One such is Aviva High Yield Equity, which we first mentioned in 2020.

This fund has delivered more than 12% average annual growth over the last three, five and ten year periods, and delivered growth of 21.4% last year.

We continue to like Aviva High Yield Equity for its flexibility, its fees, and its performance. You can invest a lump sum, a regular direct debit, or both. It’s available via Moneycube for an annual management charge of 1.25%, including the cost of financial advice.

In general, funds like this are invested in international businesses with strong brands and pricing power. Consider Microsoft, the second-largest holding in Aviva High Yield Equity.

It’s used by almost every household and business in the western world. It has a strong legacy business in computing, a leading presence in current growth engines such as cloud infrastructure, and is in the vanguard of the next generation of technology, for example in gaming and artificial intelligence. On top of that it pays a steady dividend.

Whatever the weather, funds like this are a suitable home for many people investing their money in Ireland.

Next steps

At Moneycube, we know everyone’s circumstances are different. The best investments for you right now might well be different from the funds we’ve highlighted above. But with more than 6,000 funds at our fingertips, we’re confident we can find a fund to suit you.

We hope these ideas will give you a starting point to invest money in Ireland in 2024. Now you can get in touch, or use our online platform to design an investment plan that’s right for you.

You must be logged in to post a comment.