Moneycube’s midyear market review 2024

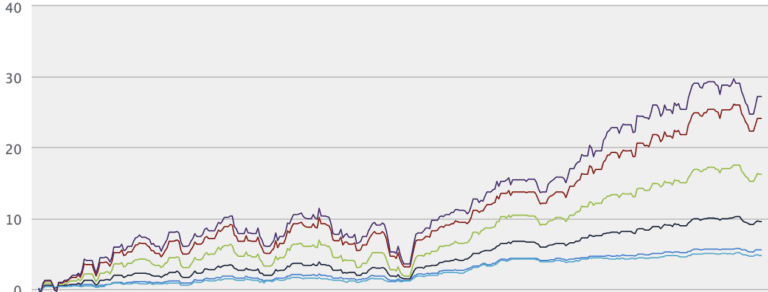

Investors in risk assets will be pretty satisfied with the first half of 2024. Most funds delivered sustained positive results. Investors were rewarded in almost all asset classes, with equities up over 15% in Euro terms, bonds delivering continued yield, and gold and silver both reaching their highest prices in over a decade. Read Moneycube’s … Continued

You must be logged in to post a comment.