Zurich Prisma funds are one of the best-known multi-asset ranges in Ireland. Against comparable funds, they are consistently at or near the top of their peer group. In fact, around 100,000 people in Ireland have invest in Prisma. So what are Zurich Prisma funds, how do they perform, and should you invest in them?

What are Zurich’s Prisma funds?

Launched in 2013, Prisma is a range of six multi-asset funds. The funds have €10.3 billion of assets under management, making them one of the larger Irish-managed investment fund ranges (all figures in this article are as at 31 March 2023 except where stated).

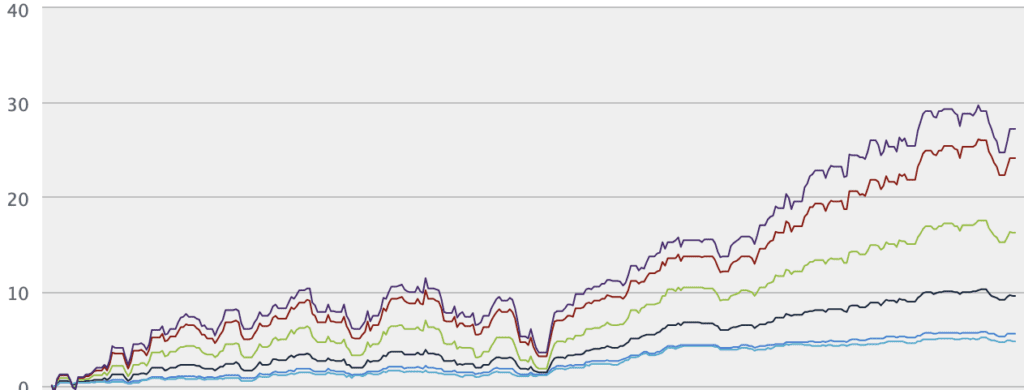

Nearly 40% of that money, or €4.1 billion, is invested in a single fund, Prisma 4. But the six funds are managed as a group, with a sliding scale of risk-reward for different appetites. Prisma Max may have greater volatility – and long-term performance – than Prisma 4. But if the managers are doing their job, the shape of its performance curve should be similar.

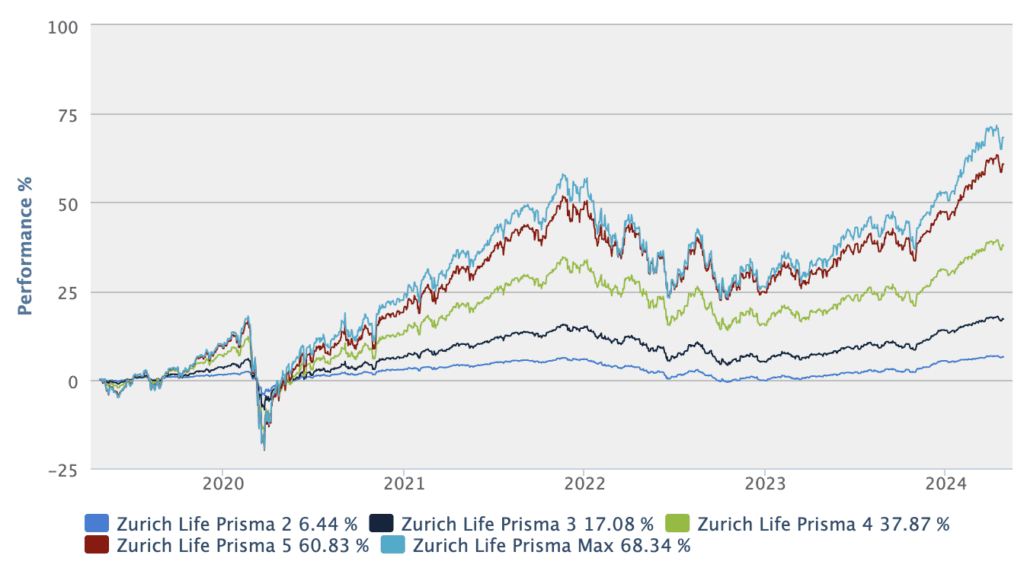

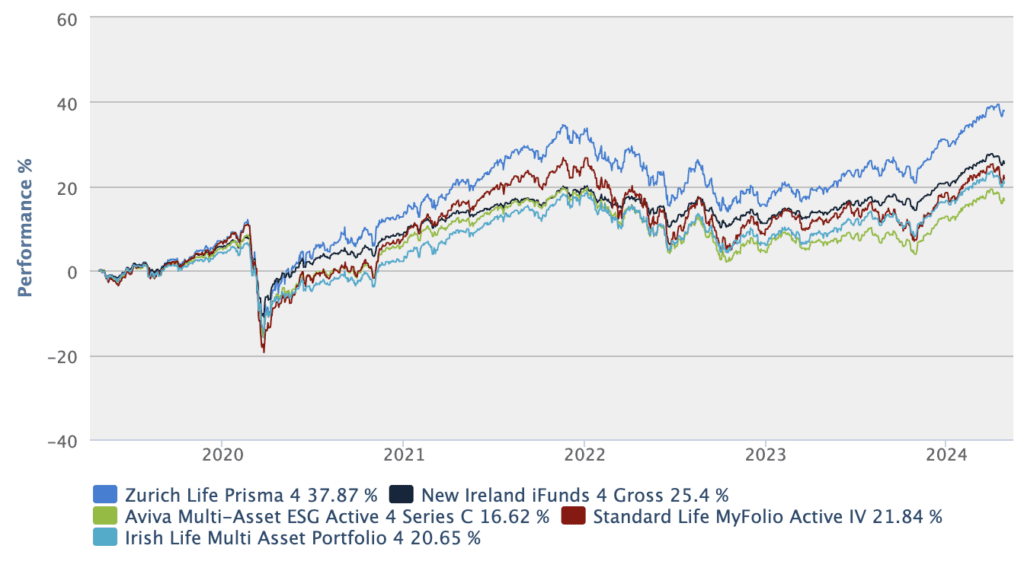

And it is, as can be seen in this chart showing its recovery from the pandemic market crash over the last five years (Prisma Low was launched in 2021 so isn’t in the chart).

There are three key elements to Zurich’s Prisma funds:

1. A multi asset approach

Multi-asset funds aim to give you exposure to numerous asset classes in a single fund – typically equities, bonds, and commercial property – plus commodities like gold and soft commodities (typically foodstuffs) in the case of Prisma.

2. Actively managed

The funds are actively managed by the investment team in Blackrock, Co Dublin. This fund management group manages upwards of €30 billion in assets, making it one of the largest managers in Ireland. If you are looking for a pure index, or passive approach, there are other alternatives.

Zurich’s active approach has enabled them to be nimble. It also appears to enable them to take a less rigid, more judgement-based approach to managing short-term volatility. For example, the managers ploughed back into equities in early 2020 when the extend of government pandemic support to the global economy became clear, delivering significant outsize returns to investors.

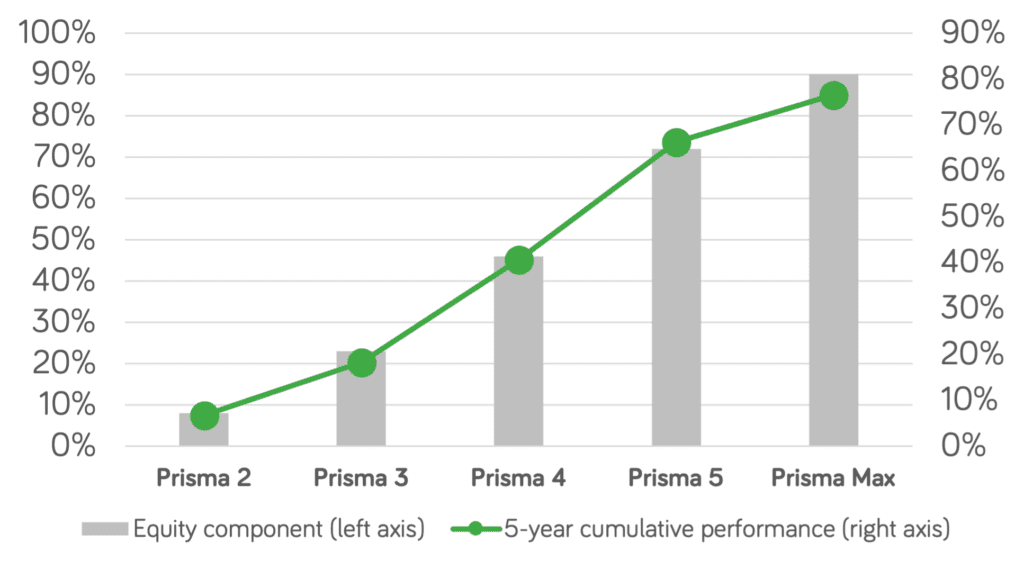

3. Equity holdings are the bedrock

The equity portion of each Prisma fund is the core driver of returns. The individual equity selection in the Prisma range tends to be uncontroversial. The top four equity holdings, for example, are no different from an index of world shares: Apple, Microsoft, Alphabet and Amazon.

This leaves the Zurich Prisma funds open to the charge of index-hugging. But in reality it is appropriate for the vast majority of pension and investment users of this fund, who are looking for a representative slice of the market, rather than to hold niche positions (there are other funds for that).

And the managers don’t invariably follow the index. If they did, the seventh-largest holding at the start of this year would have been Tesla – a stock that lost 29% of its value between the end of 2023 and 31 March 2024. Notably this stock doesn’t make the top ten in Zurich Prisma fund’s equity holdings. Prisma funds tend to avoid extremes.

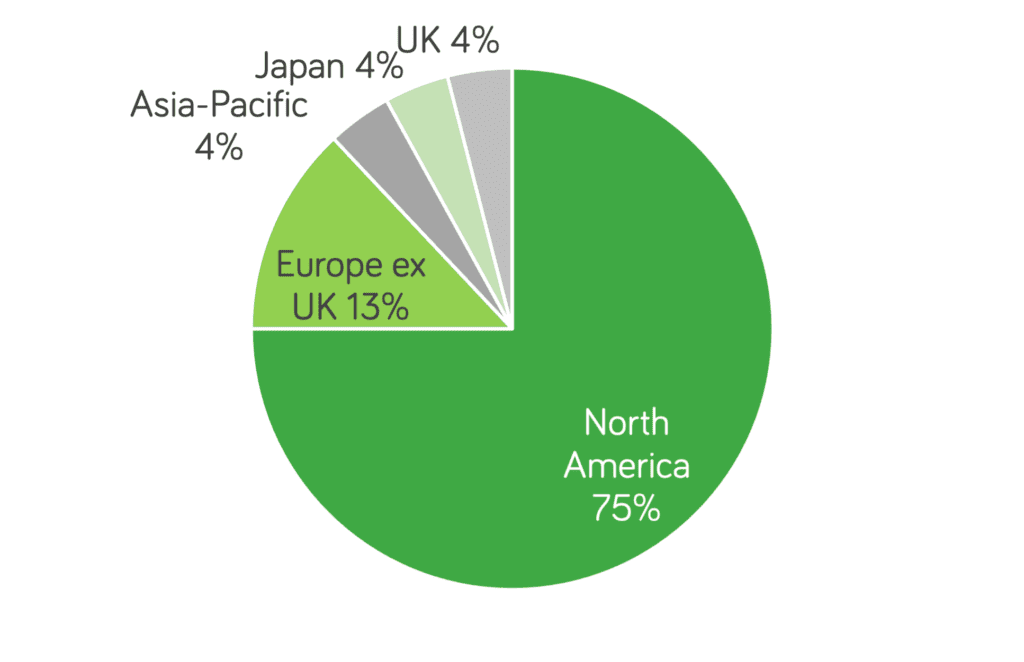

The geographical split of Prisma equity holdings is also pretty representative of where global capital is invested. In particular, the funds reflect the strong recent performance of the American stock market, with just over 75% of the stock exposure in North America as the chart shows. This is up from 63% just two years ago.

In fact, this is slightly more than the overall North American weighting of global capital (74%). And Prisma’s active approach does influence stock selection. For example, the managers have spoken of a preference specific sectors in the US market, namely technology and discretionary consumer goods. In contrast they prefer to avoid more utility-style stocks such as telecoms and consumer staples. (That kind of exposure is available through other Zurich funds, in particular their Dividend growth fund).

There are six funds in the Prisma range (the newest addition, Prisma Low, created in 2021, is very small at 0.2% of the range, so we’ve not covered it in detail here).

Leaving Prisma Low to one side, Prisma 2 is the lowest risk-reward, with fully 87% of the fund invested in cash and short-term bonds. As a result, it’s hardly a fund you would choose if you’re seeking meaningful investment growth. It’s the kind of fund you might use to put your money into if you were on the cusp of drawing down the lump sum from your pension.

At the other end of the scale, Prisma Max is almost all equity. With listed shares at 90% of the fund, and just 3% in bonds, it’s at the limits of what you can truly call a multi-asset fund.

The chart below shows the percentage of each Prisma fund which is invested in equities. The link to long-term performance is pretty obvious.

How does Prisma compare with other alternatives in the Irish market?

Irish investors can access several thousand investment funds via Moneycube, so comparing fund performance can get complicated. But for most investors, the main alternatives to the Prisma range are the in-house actively managed ranges of Zurich Life’s main competitors in the Irish market.

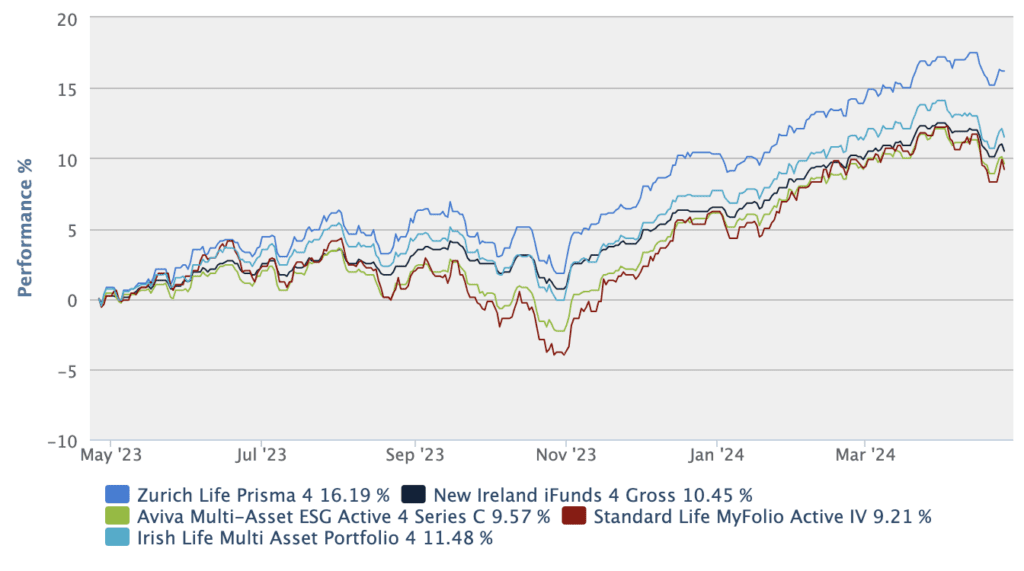

We’ll compare Prisma 4, the largest fund in the range. The comparable multi-asset funds are Irish Life’s MAPS, Standard Life’s MyFolio, Aviva’s in-house range, and New Ireland’s iFunds.

All have an equity allocation of between 45% and 60%. (Zurich’s Prisma 4 fund is presently low in equity allocation at 46% compared to many peers, reflecting their active choice to access what the fund managers judge to be relatively lower risk returns in bonds at present).

So are Zurich Prisma funds any good?

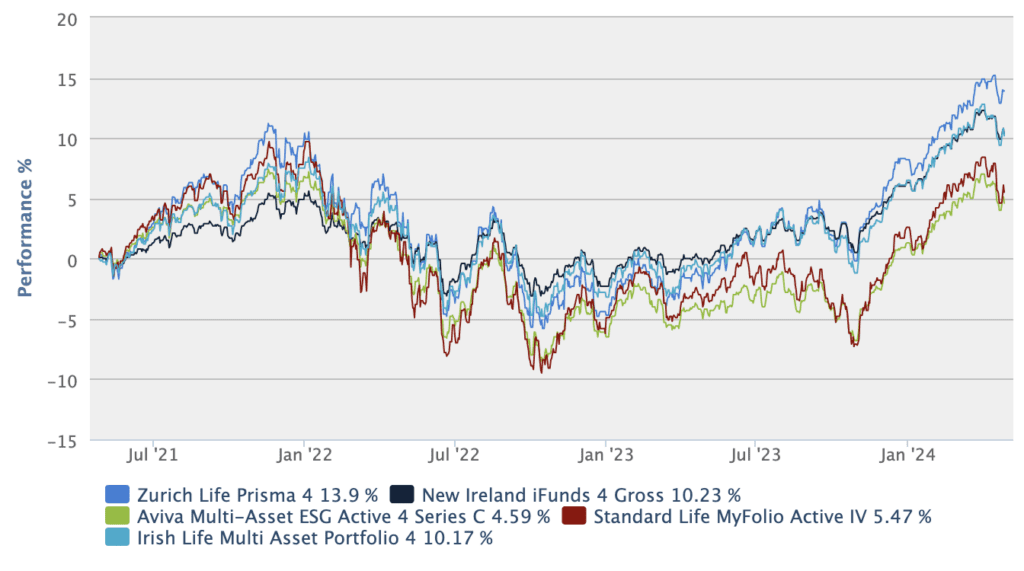

The charts below shows Zurich Prisma 4’s performance versus these competitors over 1, 3 and 5 years.

Over the 12 months to 31 March 2024, Prisma 4 is up 16.2%. Irish Life’s MAPs fund is its nearest rival, coming in at 11.5%, with the others in the 9-10% zone.

But a year is too short a time to judge an investment fund, particularly in today’s volatile times. Did Prisma simply have a lucky streak in the second half of 2023 as markets recovered?

The folllowing chart shows how this set of funds performed over three years.

Here, Prisma’s outperformance becomes more obvious. Through a sustained poor period in market performance, Prisma investors are more than 3.5% ahead of the nearest competitors (Irish Life MAPS 4 and New Ireland iFunds 4), and more than 8% ahead of the Aviva and Standard Life funds.

And over five years, Prisma extend the lead further, as the final chart shows. Over the last five years, Prisma 4 has delivered cumulative growth of over 37%, with the nearest competitor more than 12% behind.

The Zurich Prisma funds range has a consistent track record of outperforming its main competitors. And as we’ve discussed elsewhere, Zurich’s fund range is generally available at better costs than many competitors. This makes it a very strong proposition for lump sum and regular investors, and pension savers alike.

Sources:

You must be logged in to post a comment.