Irish savers have more than €22 billion invested in multi asset funds. So what are they, and what’s so attractive about using them to build your savings?

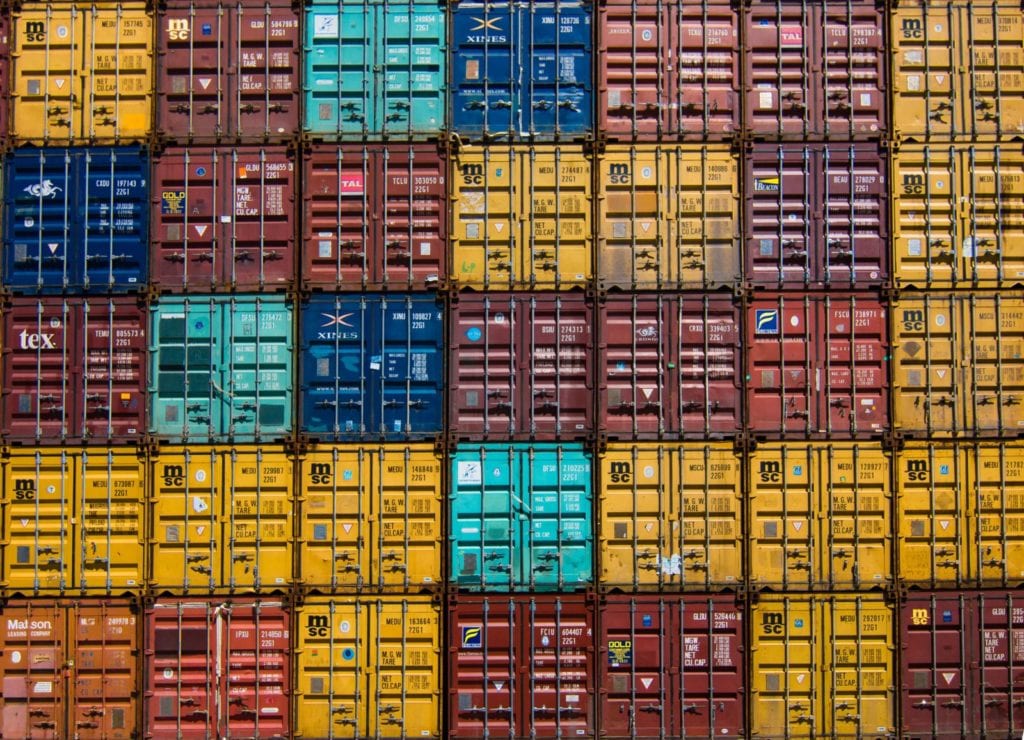

A multi asset fund does what it says on the tin: it is an investment fund that can hold lots of different kinds of assets. That might include, for example, shares, bonds and cash, in different regions of the globe. By contrast, many funds are confined to a specific region and type of asset.

Multi asset funds are increasingly popular in Ireland for three good reasons: diversity, price and flexibility.

Multi asset funds offer diversity

The idea here is that having a broad range of assets in a single fund will smooth the performance of the fund.

Over time, one kind of investment (for example, oil companies) might be having a tough time. At the same moment another (for example, tech stocks) may be riding high. A multi asset approach balances this out by having exposure to a bit of both investments.

On the other hand, an investment which is concentrated on a more specific area (Irish commercial property, for example) is more likely to jump up and down in value.

Price advantage

It pays to buy in bulk. One of the advantages of a multi asset approach is that these funds are big.

Among the Irish insurers, a couple of Irish Life and Zurich’s funds now hold in excess of €1 billion. And Aviva, New Ireland and Standard Life also runs funds (which Moneycube can help you access) with several billion euros of investors’ money.

That brings economies of scale, which can be passed on to the investor in cheaper fund management charges and stronger returns.

Flexibility

Flexibility comes in two forms here. From an investor’s perspective, the Irish market now offers a good range of multi asset funds to choose from. Most providers offer a range of at least three risk/ reward options. Plus, you can dial your risk tolerance up or down over time.

And multi asset funds are flexible for the fund manager too. That enables them to shift in and out of different investments in an attempt to maximise returns within their stated risk profile.

A core investment for most savers

With advantages of diversity, price and flexibility, Moneycube believes multi asset funds are a core investment for most savers to own.

Get started with Moneycube today.