Moneycube’s midyear market review 2025

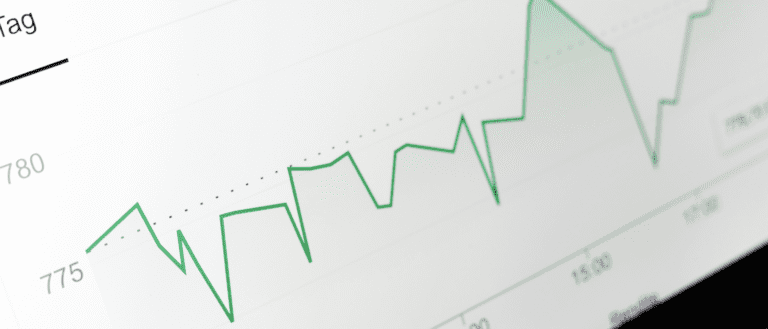

Investing your money in the first half of 2025 was a lesson in the basics. If you chose to spread your money among different geographies, asset classes and industries, and stuck to your plan, you’ll have done all right. If you made major changes, things could have gone either way. On any given day, things … Continued

You must be logged in to post a comment.