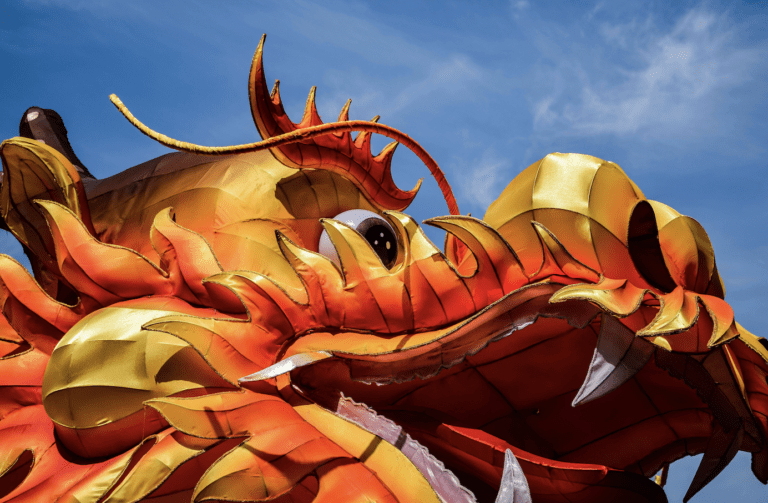

Investing in China: where did it all go wrong?

China’s stock market hit a five-year low in February. As China celebrates new year, what’s gone wrong? It’s not long since investing in China was the big new opportunity in investment markets. Alongside the west coast of the US, it was a region of the world capable of building trillion-dollar tech firms. It had a … Continued

You must be logged in to post a comment.