The last six months have had their fair share of drama. There have been bank failures and price falls – but also asset price recoveries in some sectors, an improving inflation trend, and continued economic resilience in most of the developed world.

As we approach the half-year mark, it’s time to look at what has happened, how things are likely to unfold in the second half of 2023, and what it means for your investments and pensions.

Read our review of inflation, interest rates and valuations to understand why Moneycube sees scope for recovery in prices in the months to come.

A promising start

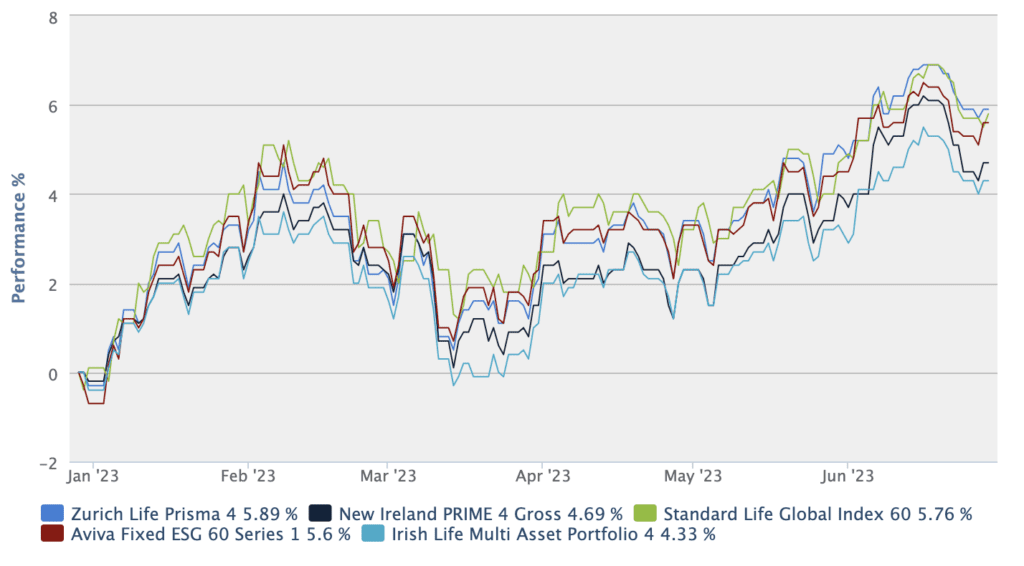

Overall, 2023 is off to a good start, with investors in a typical 60:40 multi-asset fund from Ireland’s main life assurers up as much as 6% so far this year.

Source: CSS

This chart also shows that it has been a volatile ride however, and as we’ll see, it has been led by a handful of companies which have experienced spectacular revaluations. In general, the big risers in the first half of 2023 have been the technology companies which were very badly hit in 2022.

The key question for investors is whether others will follow in the second half of this year.

Inflation continues to make the weather

It’s hard to exaggerate the importance of inflation in financial markets over the last 18 months, and for the foreseeable future. It has affected every sector you can invest in.

From the valuation of equities (particularly technology stocks), the performance of businesses (particularly those which struggle to raise prices), and the price and returns on bonds; to property and the value of cash in your pocket, inflation has altered asset prices.

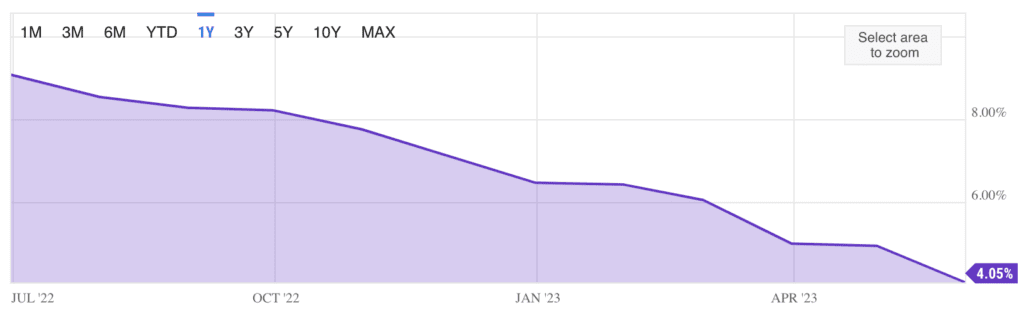

On the positive side, there’s a clear trend of declining inflation in major economies, led by the US. As the chart shows, the US rate of inflation has been declining for a year now.

Source: Ycharts

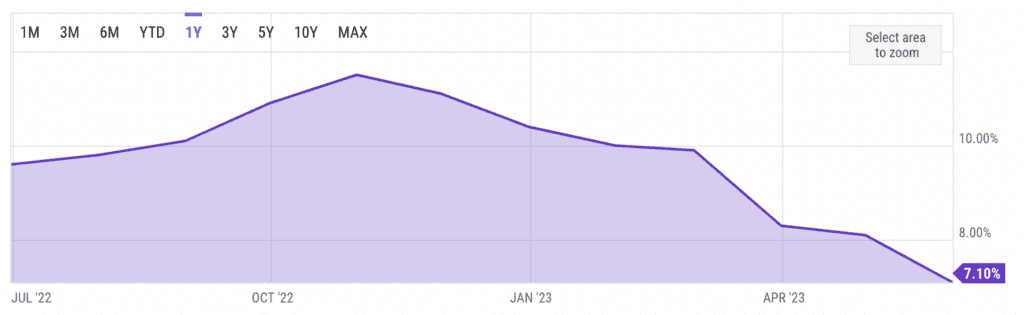

The trend in the Eurozone looks similar, albeit inflation didn’t peak until three months later.

Source: Ycharts

Source: Ycharts

Interest rates: the ‘last mile’ is the hardest

Declining inflation brings the prospect of an end to the cycle of rising interest rates. But commentators have warned that rates themselves may not be cut before 2024 – and that this tough last mile is what is needed to put paid to inflation.

Certainly it is vital for a market recovery that inflation is well and truly contained. And the price of that could mean tipping the global economy into a recession (which would reduce inflation by curtailing demand for many goods and services).

From an investor perspective, it’s worth remembering that the markets are not the economy. In fact, major gains in asset prices often kick off during recessions.

Winners in the first half of 2023

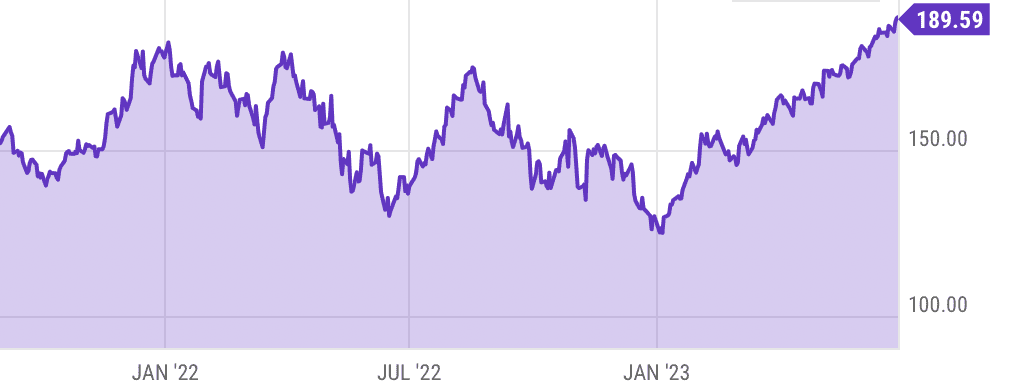

Meantime, there have been some strong recoveries in the first six months of this year. This was led by technology stocks, recovering from sell-offs in 2022 as well as changes in their businesses – including many painful layoffs in the sector in Ireland. At the end of the first half, Apple was even nudging to become the world’s first $3 trillion business.

Apple’s path to $3 trillion is a case study in the ups and downs investors must tolerate for this level of growth. In fact Apple briefly hit this milestone on 3 January 2022.

By the end of last year it had fallen by around a third, to the $2 trillion mark. Its recovery – interrupted only slightly by March’s failures in the banking sector – began in earnest at the start of this year.

Even more dramatic has been the performance of Nvidia, the semiconductor maker which is seen as vital to power the growth of artificial intelligence. Nvidia more than tripled in value in the first half of the year.

Although these are stories of equity growth rather than decline, they are also a useful reminder of why using investment funds holding multiple assets is a sensible way to dampen down the volatility and risk associated with any single equity holding.

Nvidia, for example, looks extremely highly valued at a forward price/ earnings multiple of 65. That means that the forecast rate of earnings, investors would need to wait over half a century for those earnings to add up to the share price. Of course very strong growth is forecast for Nvidia – but expectations are now very high.

Catch-up or catch down?

The key question is, will the wider market catch up with the handful of mainly tech stocks that led the recovery in the months to June? Or will those tech stocks ‘catch down’ with the wider investment market?

At Moneycube, we believe a lot of building blocks are in place for a wider recovery in valuations. From falling inflation, to the end of the interest rate cycle, a stable global economy (with the OECD predicting economic growth of 2.7% this year) and recovering consumer confidence, and reasonable valuations by comparison with long-term norms, many of the building blocks are in for better times ahead.

So while we expect a wider catch-up, the timing and location of that catch-up are difficult to predict. Against this backdrop, we favour being highly diversified, across geographies and asset types.

You must be logged in to post a comment.