Welcome to Moneycube’s annual roundup of the best investments available in Ireland.

Jan 2025 update: Our more recent post highlights the best investment opportunities for your money in 2025.

We’ve chosen five funds we think have strong potential for the year ahead in the wake of nasty 2022, and a promising start to 2023. If you’re looking to invest money in Ireland, read on.

2022 was a financial rollercoaster. From sliding bond markets, to the worst equity market performance since the global financial crisis, and the value of your cash being eroded by record inflation numbers, there were few places for your money to hide.

This year will need skill for fund managers to navigate. Bad news is filtering into the wider economy, with job losses and recession looming.

But much of this is already priced into markets. With shares repriced, inflation and interest rates stabilising, and businesses adapting to the new environment, if you invest in a diversified and measured way – as Moneycube customers do – there will be significant opportunities for investment growth.

Whether you’re a new investor, looking to invest a large lump sum, or seeking to protect the value of your wealth, we’ve got a fund for you.

We’ve also crunched the numbers to identify our two favourite global equities funds for Ireland-based investors in 2023.

Remember, these funds are all available through our online platform, along with many more. But a word of warning at the start: everyone’s circumstances are different. We’d love to hear about your detailed requirements and advise you on what’s appropriate for your situation.

New environment, new investment opportunities

While growth is out there in 2023, volatility hasn’t gone away. There will still be significant moves in major markets on a day-to-day basis. It’s a time to invest in a measured way, taking steps to manage short-term volatility, rather than place big bets on any single trend.

At the same time, investors know they need do something to protect their money from inflation. Irish bank interest rates look set to remain on the floor. Preserving the real value of your money remains vital in this environment.

There are other lessons to learn from last year. What worked in 2022 is not necessarily right in 2023. If your investments performed strongly recently, it’s likely you had a very focused portfolio. That won’t perform in all market conditions.

For example, the oil and gas sector was a great place to be over the last 12 months, as world energy markets were turned upside down by Russia’s invasion of Ukraine. But energy prices are now falling, and Europe has shown a surprising ability to manage its energy resources through the winter. Similarly, the UK stock market, with its heavy emphasis on mining, oil and financial businesses, was one of the best performers last year. But its strength is also its weakness: heavy exposure to commodity price and interest rate risks.

Finally, there’s also a need to stay the course. Investing’s a long-term game. So we’ve shared some ideas on equity funds for the long term – perhaps via a regular monthly investment.

This might all sound great in theory, but how does it look in practice? We’ve taken a look at how €20,000 invested a year ago in our 2022 selections performed here.

In fact, you’ll find there’s a quite a lot of continuity between our 2022 choices (and our 2021 choices), and this year’s. That’s just as it should be, because investing’s a long term game. At the same time, we’ve also introduced some new funds which have proven their worth in the new economic environment we’re in.

Remember, these funds are all available through our online platform, along with many more. We can help you put in place lump sum and regular investments, big or small, to start growing your wealth today.

Best fund for new investors

Moneycube believes multi-asset funds should lie at the centre of most investors’ portfolios.

Whether you are investing a lump sum, setting up a regular investment, or both, multi-asset funds are useful. In a single fund, you can achieve the diversification, flexibility and balanced growth potential that most people need from their wealth.

For new investors, we’re sticking with a long-standing choice. Zurich’s Prisma range is a strong option for many who want to invest money in Ireland. We’ll focus on Prisma 4 here. It gives exposure to a broad range of assets, split among equites (53%), bonds (34%), alternative assets including gold and commodities (8%), and property (5%).

Prisma 4 is also spread over the globe. 69% of the fund is invested in the US and Canada, 16% in Europe, 6% in Japan, and 4% in Asia-Pacific.

Short-term, there’s no doubt Prisma 4 has delivered disappointing results. It suffered in the early months of 2022 as bond markets fell at the same time as equity markets. But it has stabilised more recently. And one of the big prospects for growth this year is a recovery in the bond market, so Prisma 4 offers strong prospects.

More importantly, it has a long-term track record of on-track returns, delivering on average 5.9% since its launch ten years ago. In 2019 and 2021 it grew in excess of 15%, so there are grounds to believe it is poised to capitalise on the recovery when it comes.

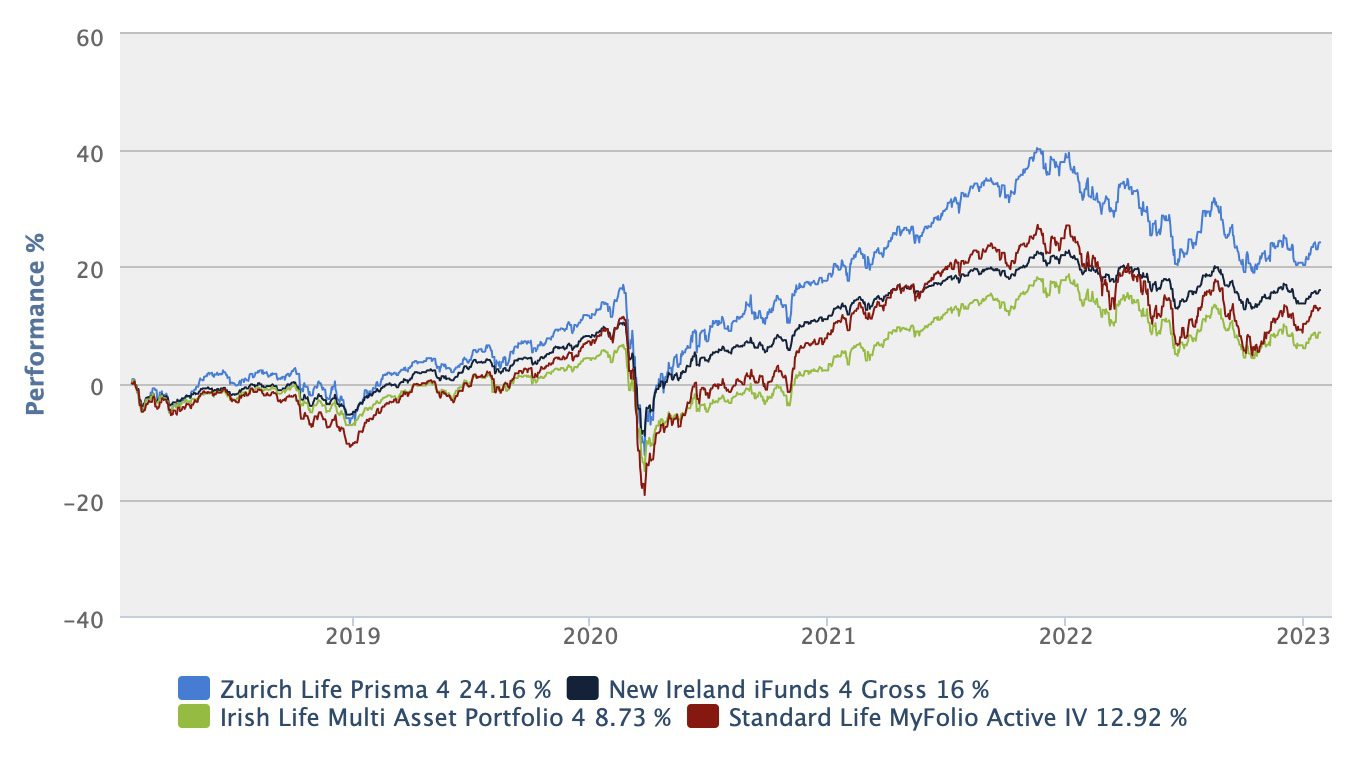

In the last five years (to January 2023), this fund has returned 24.2% total growth as this chart shows.

In fact, Zurich Prisma 4’s performance is substantially better than comparable funds from its competitors, Irish Life, New Ireland, and Standard Life over the last three and the last five years.

Here’s a comparison:

For contrast, your money in the bank has earned less than 0.5% in interest during the same period.

As a second contender, it’s worth considering Goodbody’s Dividend Income 4 fund, which has delivered a stronger pre-charges performance over the same period: up 38.1%. Two aspects of this fund are distinctive.

Firstly, GDI 4 has a focus on investing in quality stocks. It is not motivated by the prospect of buying stocks at a bargain low price, or high-growth stocks at a higher price. Instead they are seeking quality: resilient businesses which can deliver strong operating performance year after year. This tends to lead it towards well-established businesses medical technology business Stryker and retail chain Dollar General.

Secondly, GDI4 has more protection against losses than many multi-asset funds. They do this by using a portion of the fund value to but options (essentially insurance) which pay out in the event that the market falls. This has cushioned the performance in recent month (although it acts as a drag on performance when the market grows).

This comes at a price however, and GDI 4 tends to cost 0.25% more per year in management charges than other multi-asset funds in the Irish market.

Best fund for larger lump sums

If you have a lump sum of around €50,000 or higher, it’s time to consider using Moneycube to build your own portfolio.

If you’re willing to handle your own tax affairs, you can open a much wider world of fund options, and significantly drive down your overall cost of investing.

We generally recommend a portfolio of at least five such funds. So it’s hard to pick a single fund in this category.

We build our portfolios to give an appropriate spread of global diversification, wealth preservation, and growth equity.

With this approach, you can introduce specialist exposures to specific regions or industries. To give you an idea of what is out there, here’s a recent interview we conducted with the Singapore-based manager of a fund focused on Asia, Abrdn New Dawn.

You can read more about our approach to investing larger lump sums here.

Best investment to invest money in Ireland for wealth preservation

It’s no secret that inflation is seriously eroding the value of your cash savings. Consumer prices rose 8.2% during 2022. In more concrete terms, a basket of shopping that would have cost you €92.42 at the start of the year would have left you no change from €100 by the end of the year.

That’s why we’re tipping Ruffer Investment Company for a second year running. This fund is focused on preserving the real value of your capital. Described by its managers as the ‘alternative to alternatives’, it has not always been popular in a decade where tech stocks have ruled the markets. But it came into its own last year to preserve investors’ capital, staying flat in Euro terms.

Run from Edinburgh, UK, there are several reasons to consider Ruffer to preserve your wealth as part of an investment portfolio.

1. A true alternative

Ruffer offers exposures which are non-correlated with a typical equity and bond portfolio. Some describe it as a hedge fund. For example, gold makes up 4.5% of the fund, options 18.5%, and cash and short bonds over 35%, giving the managers firepower to capitalise on opportunities.

2. Ruffer’s not afraid to be radical

In 2020/21, Ruffer moved 2.5% of its assets into Bitcoin, believing there was a major opportunity to hedge against inflation. The trade (exited by April 2021) reportedly netted £1 billion – and proves that managing money defensively does not simply mean playing it safe.

3. Focus on not losing money

Ruffer’s ultimate aim is not to lose money in any 12-month period. For the managers, relative returns are unimpressive. If markets fall 25%, losing ‘only’ 20% of your money isn’t exactly a success, they say. And they accept this can mean enduring periods of low return while others race ahead:

When markets are rising strongly, investing with Ruffer can be like riding a tractor on the motorway, plodding in the slow lane.

It’s only when the motorway sinks into boggy marshland that a tractor proves to be a wise way to travel.

– Ruffer Investment Company

While a tractor is not as exciting as a Ferrari, there is a role for an all-conditions vehicle in many investment portfolios.

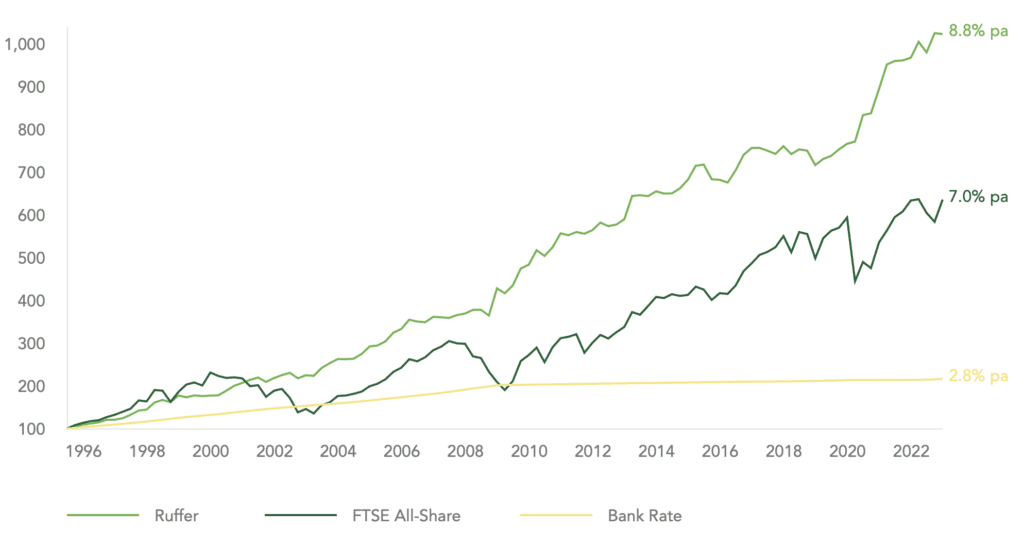

You can see the consistency of Ruffer’s approach over the long term in the chart below.

Source: Ruffer Investment Company

Two of the best pure equity funds for long-term investors

Long-term investors can afford ride out short-term market dips. That means they can take more risk with their money, to create the potential for better growth. We’ve selected two funds to fit this bill. One is actively managed in Dublin. The other is a pure passive solution from global leaders Vanguard.

Index investing with Vanguard

If you simply want a slice of what is going on in companies all around the world, a ready-made portfolio from Vanguard might be for you. Using this route, we’ll help you invest into four index funds, giving you exposure to the US S&P 500, and major European, Japanese, and emerging market stocks.

It’s hard to beat this approach for diversification among companies. Taken together, this portfolio holds positions in over 2,700 companies. And it has delivered average annual growth of 10.9% over the last ten years.

You can read all about Vanguard and index fund investing here.

Active management with Aviva Investors

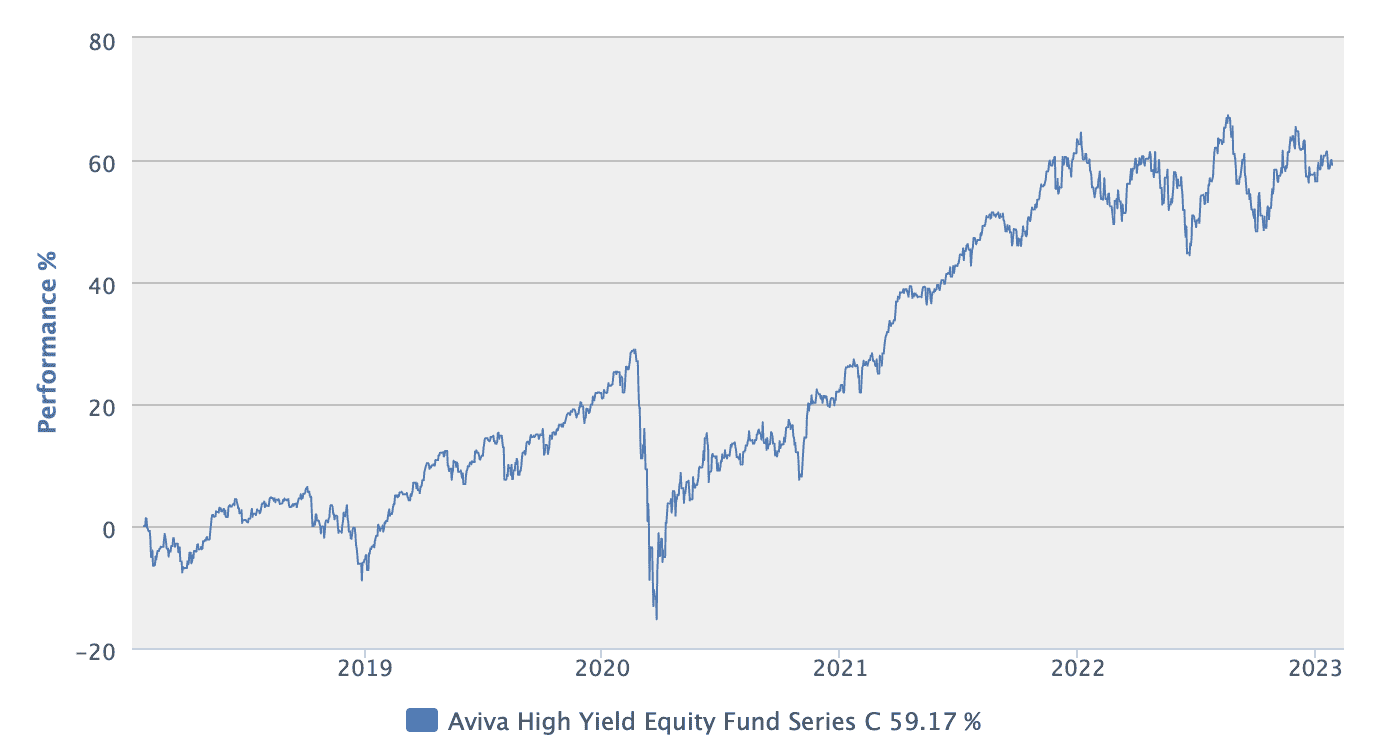

If you’re contemplating investing a large lump sum there are also a number of funds which have proven their ability to deliver in many different market conditions through active stockpicking. One such is Aviva High Yield Equity, which we first mentioned in 2020.

This fund has delivered more than 10% average annual growth over the last three, five and ten year periods, and avoided losses despite everything in 2022.

We continue to like Aviva High Yield Equity for its flexibility, its fees, and its performance. You can invest a lump sum, a regular direct debit, or both. It’s available via Moneycube for an annual management charge of 1.25%, including the cost of financial advice.

In general, funds like this are invested in international businesses with strong brands and pricing power. Consider Microsoft, the second-largest holding in Aviva High Yield Equity.

It’s used by almost every household and business in the western world. It has a strong legacy business in computing, a leading presence in current growth engines such as cloud infrastructure, and is in the vanguard of the next generation of technology, for example in gaming and artificial intelligence. On top of that it pays a steady dividend.

Whatever the weather, funds like this are a suitable home for many people investing their money in Ireland.

Next steps

At Moneycube, we know everyone’s circumstances are different. The best investments for you right now might well be different from the funds we’ve highlighted above. But with more than 4,500 funds at our fingertips, we’re confident we can find a fund to suit you.

We hope these ideas will give you a starting point to invest money in Ireland in 2023. Now you can get in touch, or use our online platform to design an investment plan that’s right for you.

You must be logged in to post a comment.