We spend so much time talking about ways to invest your money… it’s time to look at some investments that are best avoided.

Whether it’s the risk of scams, returns that are too good to be true, excessive costs or risks, here are five investments that we believe are best avoided for most investors.

A couple of words to keep things positive before we start: everyone’s situation is different, so these investments may be right for some people. And if you’d like our views on the best investments in Ireland in 2021, take a look over here.

1. Unregulated investment funds: recent collapses are a warning

There has been a series of recent scandals involving unregulated funds which attract investment in the form of loan notes. Most recently, it’s estimated that around 1,800 Irish investors have lost money in the collapse of German Property Group/ Dolphin Trust.

In the UK, the 2019 collapse of London Capital and Finance prompted the UK financial regulator to ban the sale of such investments, or mini-bonds.

There are several objections to such unregulated investments. We’ll name a few.

The returns they offer are often very high, suggesting (at best) a lot of risk, or at worst, that they are misleading and unlikely to materialise.

Minibonds are also difficult to evaluate as there’s a lack of standardised investor information.

Thirdly, these investments are typically illiquid and difficult to sell at a time of your choosing.

You can read our most recent views on unregulated investments in the Sunday Times – the headline says it all.

2. Irish property: undergoing fundamental change

From commercial real estate to housing, now looks like a good time to sit it out when it comes to the Irish property market.

Commercial real estate has been under pressure since late 2019

Early in 2020 (before the pandemic), several Irish property funds delivered a hammer-blow to investors, moving pricing to a ‘disposal basis’. In plain English, that meant they devalued the fund by around 10% overnight.

To make matters worse, some then prevented investors from withdrawing their money for several months.

That might be in the recent past now. But the future for commercial property seems very uncertain. Certainly many businesses are looking to reduce their real estate footprint, envisaging a permanent increase in working from home, at least some of the time. Others are looking to renegotiate their rent.

That’s not so say there won’t be opportunity: for example, the slowdown in construction will reduce supply, helping to support rents.

But either way, there are some fundamental uncertainties in the sector.

So much for commercial property funds: illiquid, and unpredictable.

Residential property: our needs are changing

Residential property and buy-to-let is also at the sharp end of changes to how we live post-Covid. At a minimum, it seems that relative valuations will shift, with urban property seeing less demand.

For example, if your boss in Cork city is happy for you to work from home three days a week, moving 90 minutes down the road to Bantry suddenly seems a lot more feasible.

Prominent economist David McWilliams recently advised buyers to stay away from the Irish housing market if they can – we tend to agree, at least until the dust of 2020-21 settles.

3. Peer-to-peer: the risk has changed

P2P lending has grown rapidly in recent years, and most providers work in a similar way: they enable individuals to lend money through their platform, and match it to businesses or property developments which need loans. Some providers also have access to other funding so that a portion of the loan can definitely be financed.

For several years it has offered a route to reasonable returns.

But prolonged lockdowns and economic change from Covid-19 has changed the risk-reward of peer-to-peer lending.

Remember you are often lending to small businesses (one of the worst-hit sectors from everything that has happened over the last 12 months). Often, they’ve not been able to secure bank funding. They are therefore paying a multiple of the cost of bank debt to access your money.

It seems highly likely that P2P default rates will rise as businesses face continued pressure to adapt in a post-Covid world, and government pandemic supports are wound down (in Ireland and abroad).

4. Capital protected investments: expensive and risky

Moneycube has long advised against capital protected investments (also sold as kick-out bonds, tracker-bonds and guaranteed structured products).

Such investments offer the promise of a guaranteed return, and that your investment can only grow. But scratch the surface and you’ll find that is not the case.

In fact, the main thing that’s guaranteed about kick-out bonds and the like is that the investment advisor who is selling them is being paid handsomely for doing so. Read our 2017 article on the topic if you’re considering a capital protected investment.

5. Cash: going nowhere for a decade now

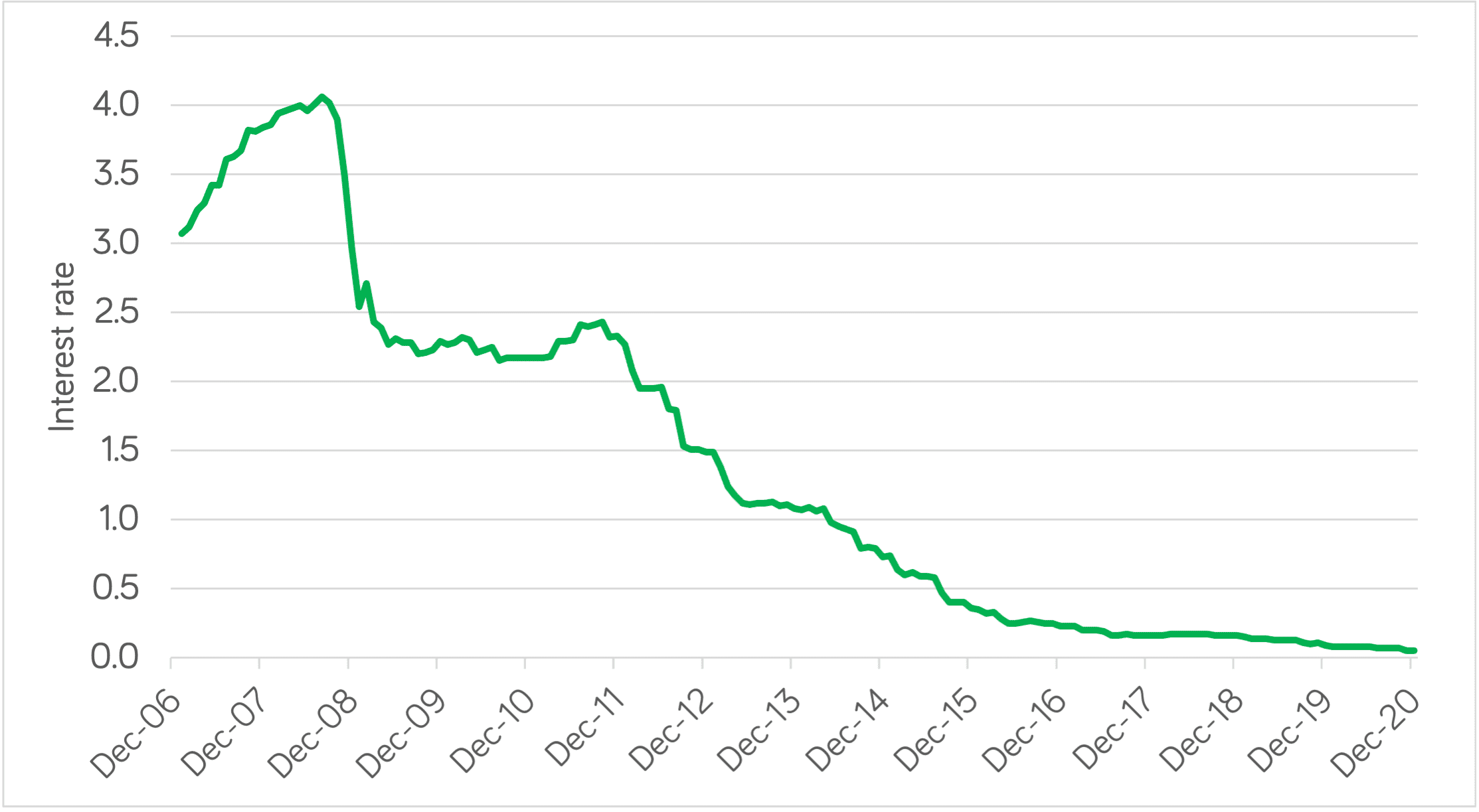

Lastly, there’s the Irish favourite: leaving cash in the bank – around €120 billion of it actually! As we’ve said recently, cash has been going nowhere for a long time.

Here’s a chart using Central Bank of Ireland data on the interest rates paid on notice accounts in Ireland since 2007.

So if these are some investments you should avoid, what are some you should consider?

If you’d like our views on the best investments in Ireland in 2021, take a look here.

You must be logged in to post a comment.