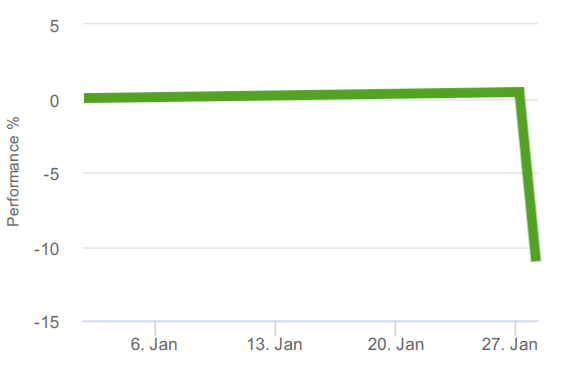

Friends First Irish Commercial Property Fund drops 9.1%

Investors in the Friends First Irish Commercial Property Fund woke up to a nasty shock today. Aviva (which bought Friends First in 2018), announced that they had “taken the decision to move our property fund pricing from an acquisition to disposal basis”. That all sounds pretty dull until you discover it means a drop in … Continued

You must be logged in to post a comment.