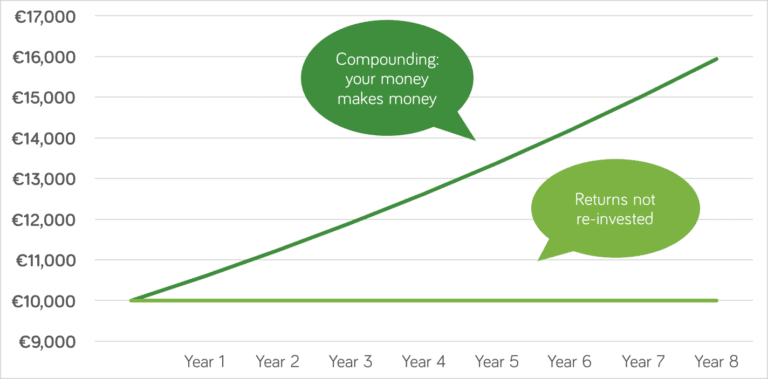

Financial advisor fees explained

At Moneycube we strongly believe in bringing transparency to investors. For too long, investing has been made seem mysterious – usually in order to charge excessive fees. Here’s Moneycube’s rundown on advisor fees to consider for when investing. Pay direct, or via commission Fees mostly come in two basic flavours: ongoing, and one-off fees – explained … Continued