One of the biggest advantages of combining your pensions is the ability to choose investments that are right from you.

With over 4,000 investment funds at our fingertips, we can almost certainly help you invest in the way you want.

For many customers, an index fund approach is ideal. A major aim in consolidating your pension is to increase transparency and gain access to a wider range of investments. Index funds address both requirements.

What’s an index fund?

Index funds are designed to track the performance of a particular market as closely as possible.

Financial markets are measured through indexes. For example, the S&P 500 index is made up of 500 major US companies.

An index funds aims to match the return of the index, typically by investing in many or all of the members of the index, and holding them in the correct proportions. In the case of an S&P 500 fund, its top ten investments would include major US businesses like Apple, Microsoft, Johnson & Johnson, and Visa. As the companies in the index grow and change over time, the investments in your pension will do the same.

It’s like putting your pensions on auto-pilot to fly to your chosen destination.

Why use index funds for your pension?

An approach centred on index funds has major benefits:

- Diversification: You gain exposure to a huge range of underlying investments, spreading your risk, and giving your money multiple opportunities to grow.

- Cost: Index funds are typically lower-cost than actively managed funds, because there are fewer expensive fund managers to pay.

- Automation: We can set your pension to cycle through investments automatically, based on your planned retirement date. In early- and mid-career, the focus is on higher-growth assets. As you approach retirement, your money will automatically move into lower-risk assets.

- Choice: If you wish, you can add other funds and investments selectively to get specific exposures – for example, to a region of the world, a particular industry, or a commodity like gold, while using index funds as the cornerstone of your pension growth plan.

So what does my pension fund look like in practice?

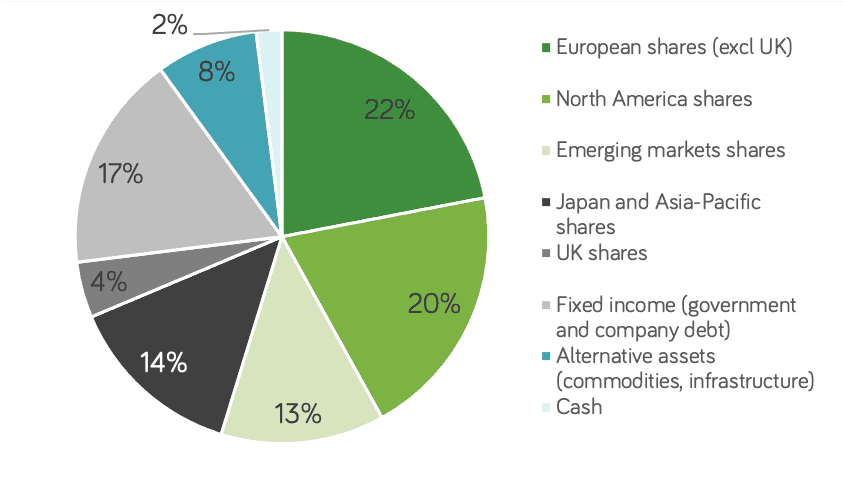

Here’s a typical investment split of how your pensions could be invested with ten years to go before retirement.

Of course, it’s simply a snapshot, and this can vary over time. But clearly a pension invested in this way is highly diversified over thousands of assets, with exposure many of the most successful companies in the world.

These days, all of this can be achieved by investing in a single fund, called a multi-asset fund, which itself invests in many underlying index funds to spread your savings very widely.