7 habits of successful savers in Ireland

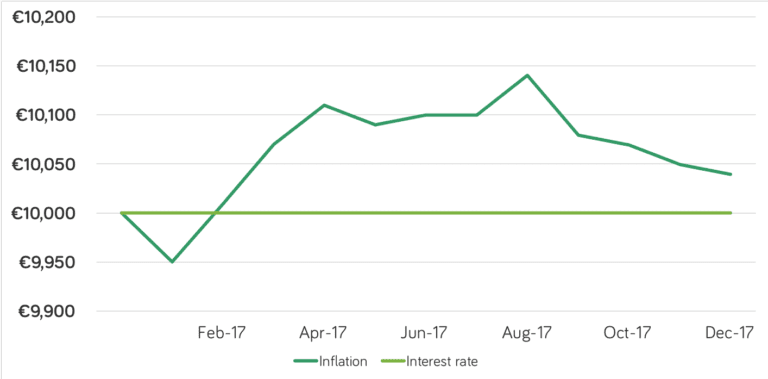

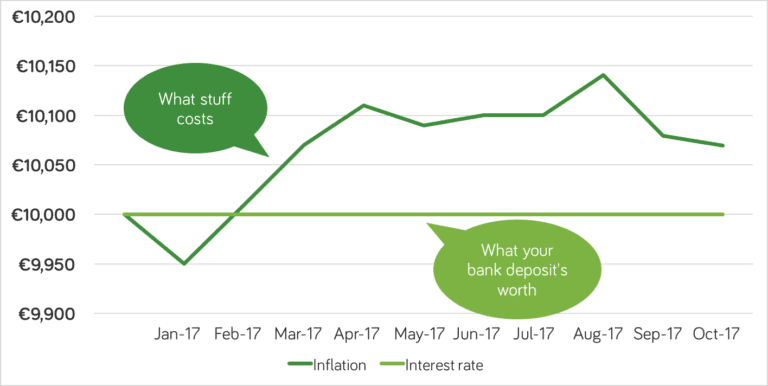

You can build your wealth significantly if you establish the right saving and investing habits now. Here are Moneycube’s 7 habits for success. 1. Turn up Successful savers get stuck in. Sure, you can build up cash in the bank. But with interest rates at near-zero, if you want to grow your savings, you need to … Continued

You must be logged in to post a comment.