The difference starting today can make to your investments

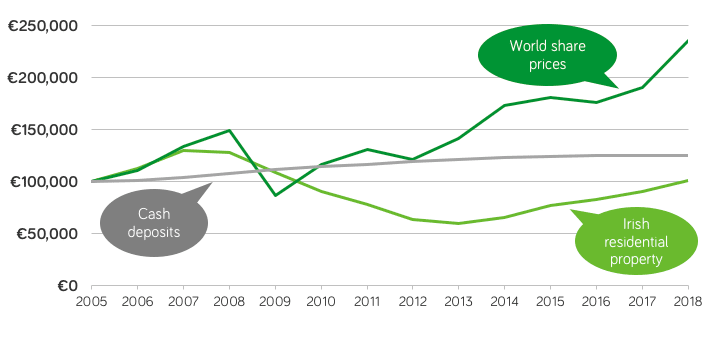

We all feel that we should have done more to build up our savings and retirement plans. But what’s important is making a start today, not worrying about missed opportunities in the past. The reason for this is compounding – that is, when the growth in your investment is reinvested, and generates additional growth. The … Continued