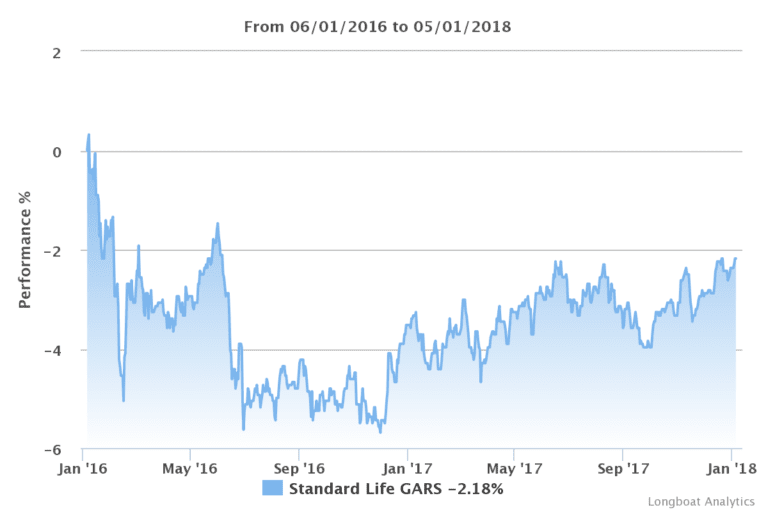

Standard Life GARS fund: time to head for the exit?

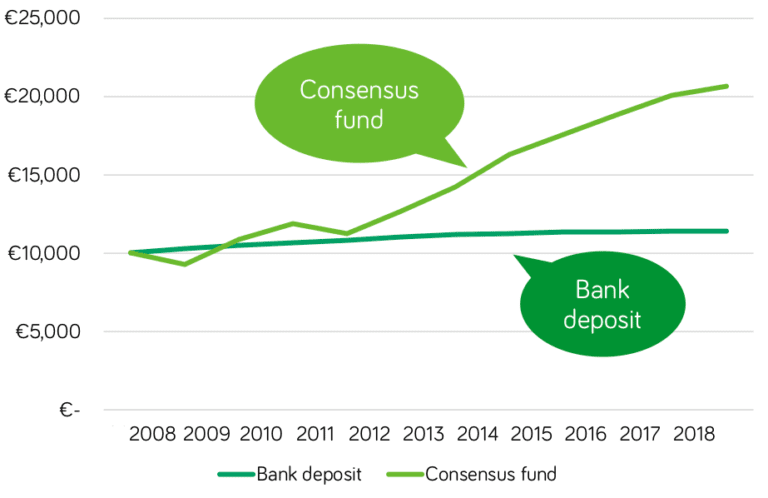

Is your money in Standard Life’s GARS fund? If the answer is yes, it’s time to review your investment strategy – and the advice you’re getting. The Global Absolute Return Strategies fund has been a favourite for Irish financial advisers and brokers in recent years. We’re wondering why. Got money stuck in GARS and wondering … Continued

You must be logged in to post a comment.