Despite Ireland’s housing shortage, it’s hard to make the numbers add up when it comes to investing in buy-to-let property.

The individual landlord faces increasing regulation, professional competition, and a big bet on Ireland’s volatile property market.

Moneycube describes what’s going on, and some investment alternatives if you’re considering a property investment.

Update 17 May 2020: Interested in Moneycube’s view on how coronavirus will affect the buy-to-let property market in Ireland? Read on here.

The maths looks difficult

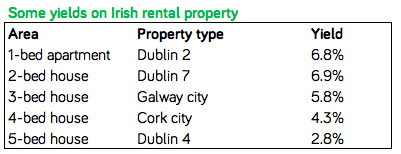

As property prices have gone up, rental yields have stagnated. Information from Daft.ie in August 2018 showed gross rental yields as low as 2.8% in some parts of Dublin! That’s before any costs you’ll incur to manage your investment.

The table below has some examples. Interest rates on buy-to-let loans start at around 4.8%, usually for up to 70% of the value.

Interest rates on buy-to-let loans start at around 4.8%, usually for up to 70% of the value.

So if you are borrowing to invest in property, you’ll need to be ready to supplement your rental receipts with cash of your own.

When you add in insurance, repairs and maintenance, and property management costs, this is a loss-making proposition for many.

And while the value of your property may go up, that’s not guaranteed. The big gains as Ireland recovered from the post-crash years can’t go on forever, and house prices are falling in Dublin.

The market is changing

Then there’s the admin and regulation. Over the last decade or so, Ireland’s residential property market has become a lot more professional. Private landlords are on the decline.

Tenants need managing. The arrival of REITs, or real estate investment trusts, into Irish residential property has set new standards for property management.

You’ll also have to complete a self-assessed tax return, if you don’t already, to pay tax on your profits. Oh – and the Residential Tenancies Board requires registration of tenancies (€90 a go).

You’ll either need to pay letting agents and accountants to handle all of this, or set aside a good portion of your own time instead.

Above all, rent controls have been introduced in the highest-demand areas, with the aim of limiting annual rent increases to 4%. Outside these areas, the government limits rent reviews to once every two years.

Investment property has hidden risks

What investors forget when they focus on property alone is the risk of putting too many eggs in one basket.

For most individual investors, their biggest asset is the house they live in. That means you already have a heavy exposure to Irish property – most likely in an area close to where you are considering buying more!

We know all too well that Irish house prices can drop very suddenly – and houses can become impossible to sell.

If all your wealth is tied up in property, you’ve very little protection against these risks.

What’s more, if you borrow to invest in buy-to-let property, a serious fall in prices and rental income can push you into negative equity and arrears.

So what should you do?

At Moneycube, we think these are all good reasons to diversify away from property into other assets such as company shares and bonds, via investment funds. (You can get started here).

And if you are dead-set on investing in property, doing it through a fund to help manage the risks could be a good choice.

You must be logged in to post a comment.