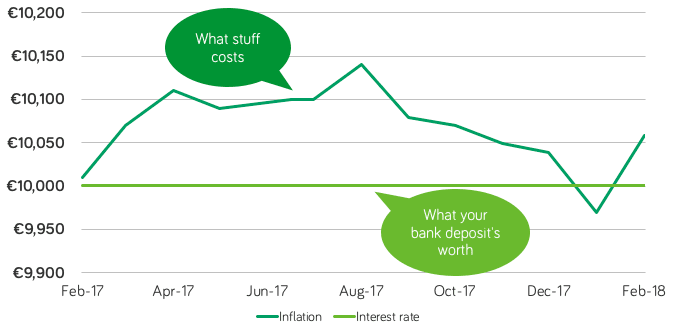

What inflation did to your savings in February

At Moneycube we believe more people should think about investing their savings. One big reason for that is that it is almost impossible now to make any money by leaving it on deposit in the bank. Deposit rates in Ireland continue at near-zero levels. Inflation’s off again But inflation has been climbing again, as data … Continued

You must be logged in to post a comment.