2017 was a great year for investors. What does 2018 hold?

By any standard, people who invested their money in 2017 did well. After markets closed last Friday, the FTSE All-World index of global shares was up a whopping 22 per cent. That was its biggest gain since the crash, and fourth-best year in the last quarter century.

If you invested in funds in Ireland, you were probably already on track to do well.

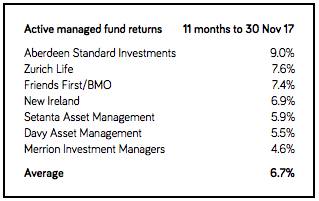

Here’s a chart of returns delivered by the main managed funds in Ireland from the people at Rubicon.

Small print: this is based on 11 months of data. These managed funds contain a mix of equities and bonds. That makes their growth lower than than the world stock market, and also less volatile.

What about investing in 2018?

There is a continued sense of optimism for investing this year.

It’s true that some assets look relatively expensive after recording strong gains in 2017, and that at some point interest rates will rise, and depress bond prices. But there are stronger more reasons to be positive.

The US has just passed major tax reforms and corporate earnings forecasts are positive. Globally, the world’s big economies are growing, and there is positive momentum.

At the same time, your bank savings continue to go nowhere because interest rates are negligible.

Overall, there will be investment growth to be had, but it may be a bumpier ride.

So what is an investor to do?

Moneycube has three simple rules of thumb for investing in 2018:

- Keep on investing: the investment market has positive momentum and it makes sense to put your money to work, rather than wasting away in a bank account. Get into the habit of regular investing now.

- Keep focused on the medium term: good investment funds are seeking out value plays, and patient investors can benefit. For example, some domestically-focused UK businesses are priced low due to Brexit uncertainty. These investments will take time to develop, but offer good potential for growth over time.

- Stay diversified: if stock markets do hit a bumpy patch, it pays to have your savings spread across numerous different assets (multi-asset funds are ideal).

Interested to point your finances in the right direction in 2018? Get started with Moneycube today.

You must be logged in to post a comment.