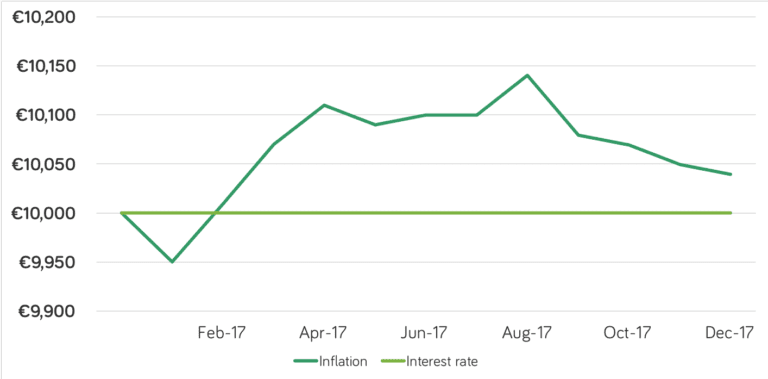

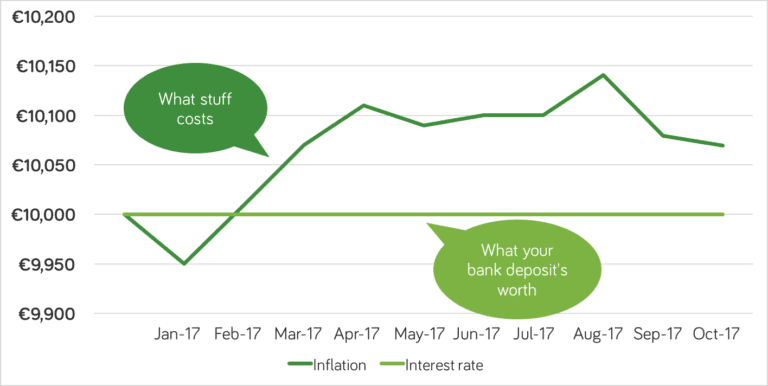

What inflation did to your savings in December 2017

At Moneycube we believe more people should think about investing their savings. One big reason for that is because it is almost impossible to grow your money by leaving it on deposit in the bank. Deposit rates continue at near-zero levels. And so did inflation in the last month of 2017, according to the Consumer … Continued

You must be logged in to post a comment.