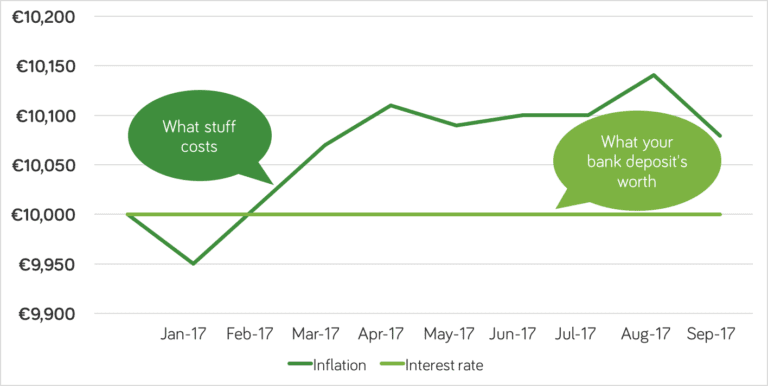

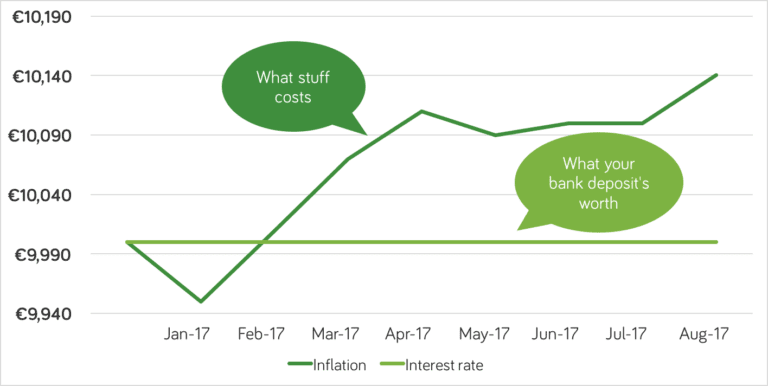

September inflation: what it did to your savings

At Moneycube we believe more people should think about investing their savings. One big reason for that is that it is almost impossible now to grow your savings by leaving them in the bank. Deposit rates continue to snooze at zero per cent or near it. Prices eased off in September… Consumers got some respite … Continued

You must be logged in to post a comment.