How robo-advice can help you build your wealth

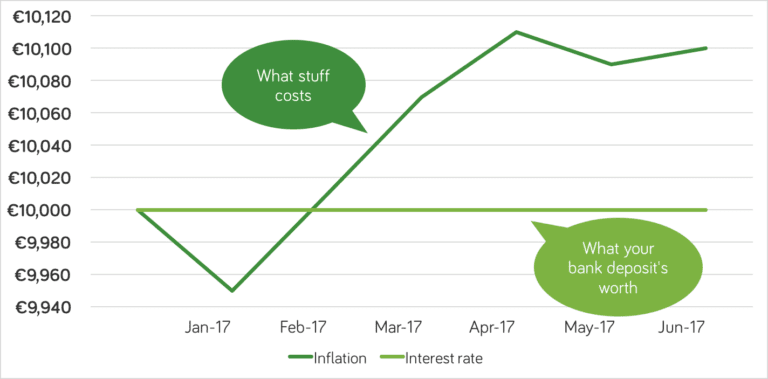

Robo-advice is changing how people in Ireland build their wealth. We’ve been blogging on Enough.ie about robo-advisors, and how they can help you take charge of your finances. What’s robo-advice? Robo-advisors, or automated investment advisors, are platforms that use algorithms to handle parts of the investment process. That reduces the need for human involvement. It means cheaper, … Continued

You must be logged in to post a comment.