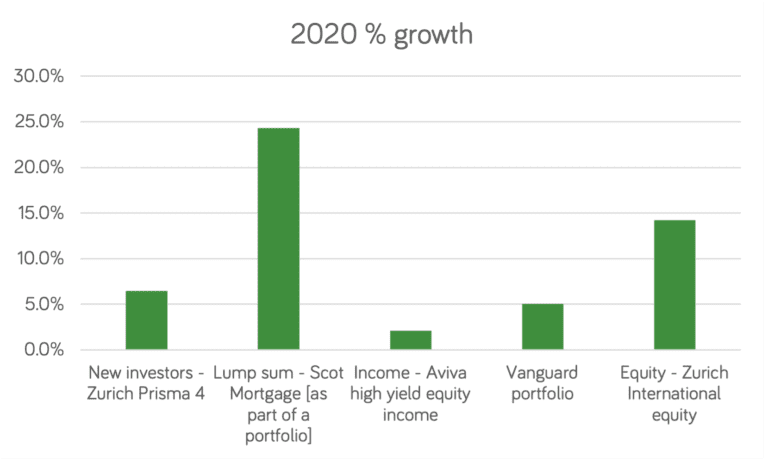

How did we do in 2020?

Each year, we pick a handful of investment funds available to Irish investors and highlight them on our blog. We’ve charted below how our 2020 selections performed. Interested in our 2023 picks? Click here to read more. There’s no doubt 2020 was a bracing year to have your money in investment funds. But for those … Continued

You must be logged in to post a comment.