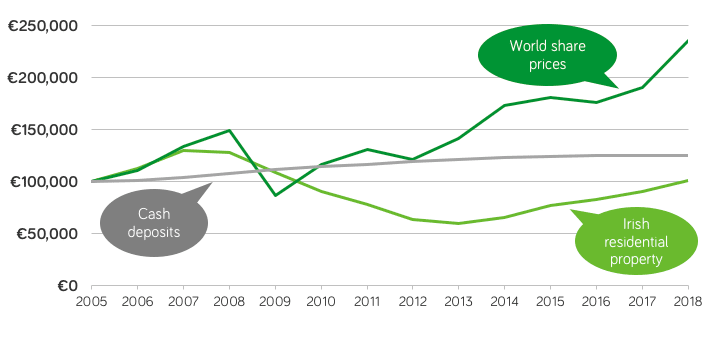

Why Irish investors need to think globally

At around €27 billion, Ireland’s largest listed company, CRH, represents around 0.03% of the market value of global listed businesses. Clearly, if you limit yourself to investing in Irish market, you are accessing only a tiny proportion of what’s out there. Only a few industries What’s more, if your money is focused on Irish businesses, … Continued