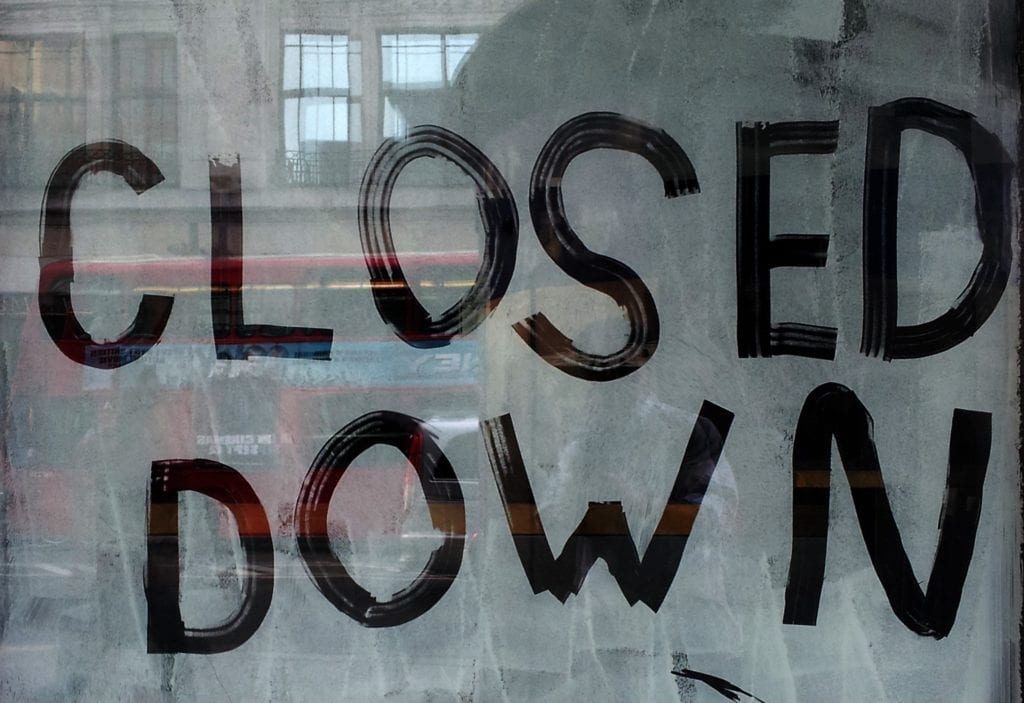

So, after 13 years in Ireland, Rabodirect announced on 21 February that they are shutting the doors. Moneycube outlines some alternatives for the hungry saver.

What’s happened?

Netherlands-based Rabobank will close down its Irish operation, Rabodirect, on 16 May 2018. That gives its customers a bare 6 weeks to sort out an alternative home for their savings.

In reality, it’s been some time since Rabodirect paid genuinely good returns on savings. At their current instant access rates, if you left €20,000 on deposit for a year, you’d earn less than €12 in interest after tax!

There are better options, but the interest you earn on bank deposits still won’t make you rich. For example, KBC offers three times the interest Rabo does on no-notice lump sum deposits.

There will be a small benefit for people who agreed to lock up their money with Rabo for a fixed period – here, the bank will pay the interest that customers would have earned over the full term of their investment.

But in general, Rabodirect’s 90,000 customers are left with a basic problem: there are very few attractive deposit account options here in Ireland.

Interest rates are tiny

One reason for this is that bank interest rates remain at basement levels.

As our inflation eater shows, the value of your bank savings simply can’t keep up with increases in the cost of living – in particular the rate of increase in house and rent costs.

Time to consider investing?

That’s why some savers have begun to consider investing as an alternative to saving – for at least a portion of their savings. For many of these people, investment funds are a great solution.

Investment funds are ideal choice if you’re new to investing because they spread your risk among many different assets, and give your money multiple opportunities to grow.

There are numerous options for new investors, from low-risk choices, to regular investment plans, to investing large lump sums.

If you are considering investing some of your savings for growth, or moving your savings from Rabodirect, talk to Moneycube about appropriate investment options for you, or get started online today.

PS – Whatever route you choose, don’t do nothing – after 16 May, Rabo will pay no interest at all, and you won’t be able to access your account online!