5 ideas to make the most of your finances in 2023

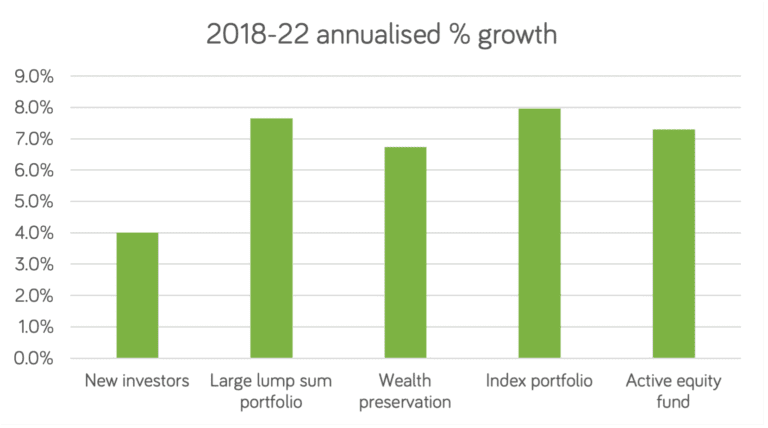

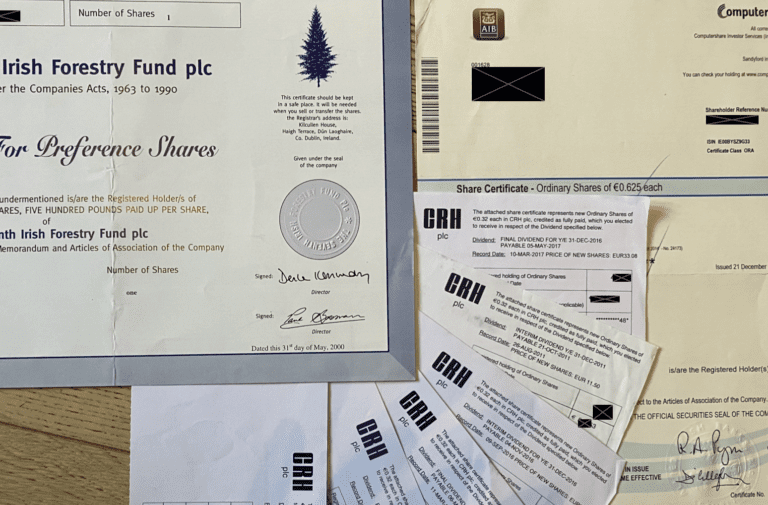

2022 has had an impact on everyone’s finances. So whether you’re in recovery mode, or looking for new ways to maximise the extra cash you’re saving, we can help you get your finances into shape for the New Year. Take stock of what you’ve got Last year saw some major moves in the financial markets. … Continued

You must be logged in to post a comment.