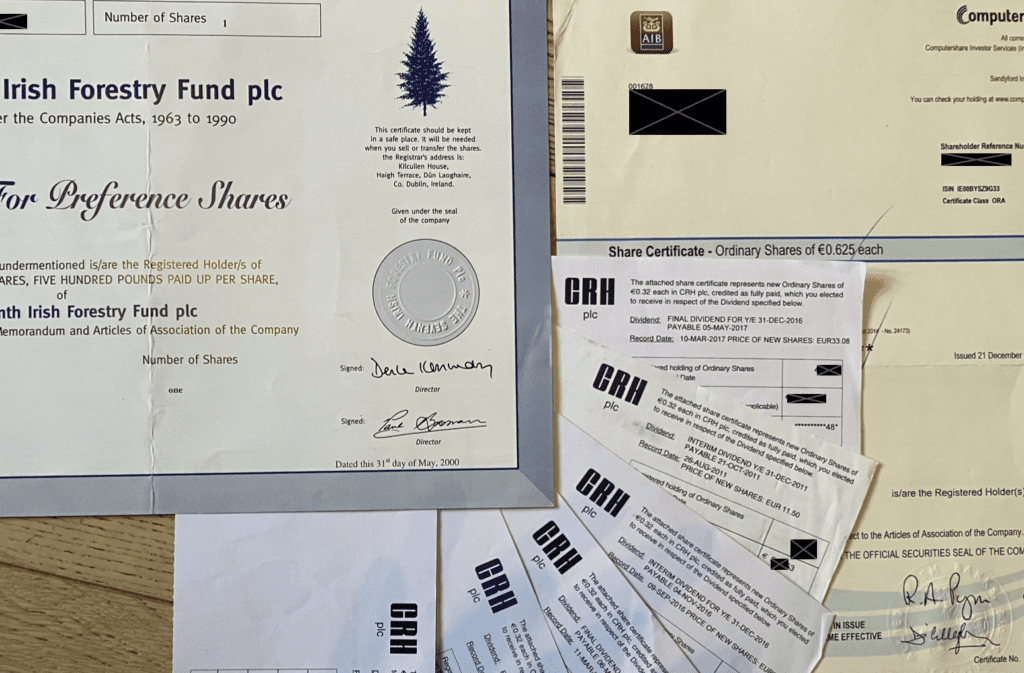

I’ve held a small portfolio of shares for many years, mainly in well-known Irish and UK companies such as CRH and Barclays. I like getting the annual report and other information from the companies. But these days the trend is to hold shares electronically. What are the advantages, and should I say goodbye to my paper share certificates?

– P.B., Co Mayo

Traditionally all companies issued share certificates to those who invested in them. The paper document arrived in the post, and was your proof of ownership. The vast majority of private company shares are still held in this way.

For many years however, it’s become common to hold listed shares in a nominee account instead. This certainly makes it easier and cheapers for plcs to administer their shareholder base. And while there are some disadvantages, for most people in Ireland, holding a portfolio of shares in a nominee account, rather than via paper share certificates, will make more sense. Here’s why.

Easier to manage

Above all, holding shares in a nominee account makes them much easier to manage.

For example:

You can buy or sell securities in real-time.

You can see a daily valuation online.

And you can receive the dividends directly into your investment account.

You do lose some control

But some benefits of holding shares direct are lost when you give up your paper certificates. In particular, because you are no longer a direct shareholder, but instead a beneficial owner (that is, the shares are held for your benefit) via a nominee account, you don’t receive annual reports, AGM attendance cards and the opportunity to vote on issues like director nominations, executive pay and so forth.

For most people, that is bearable as the information is available online, and votes are generally dictated by large institutional shareholders. There are moves afoot to grant voting abilities to shareholders in nominee accounts, but that has yet to arrive in Ireland.

Harder to lose

One risk with paper share certificates is that they can be lost or destroyed. Of course it’s possible to receive replacement copies – but that comes at a cost, both financial and in terms of time dealing with the shareholder administrator.

With your shares held in a nominee account, it’s clear you own them and you can get rapid access to them when you need to.

Costs are different

If you intend to own your shares forever, then doing so in paper form is cheaper. Typically using a nominee account will incur an annual charge for providing safe custody and visibility on your assets.

There is no ongoing cost to holding paper share certificates. But if you want to make any changes to your portfolio it is likely to be expensive and slow. Dealing costs, for example, are typically significantly more expensive and slow than placing a telephone or electronic trade. Fundamentally holding paper share certificates makes your portfolio a lot less flexible.

It’s also worth remembering that in the event of your death, your successors will have a much more difficult time of dealing with your estate if share certificates are held in paper form. If your investments are held in a nominee account, getting a probate valuation and distributing the assets is easily done. If you hold a portfolio of shares in paper form, getting hold the assets will likely involve hunting down documents, seeking grants of probate in multiple countries, and much more time and effort to distribute the assets as you intend.

Moving from holding your portfolio via paper share certificates into electronic form in a nominee account is a relatively simple process, known as dematerialisation. For most investors in Ireland, it makes a lot of sense. Here at Moneycube, we can advise on that work and get it done for you in a matter of days.