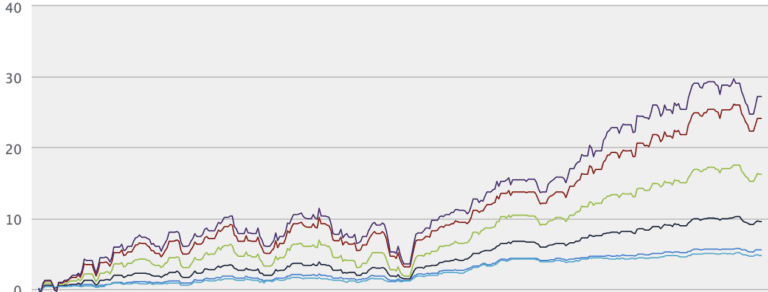

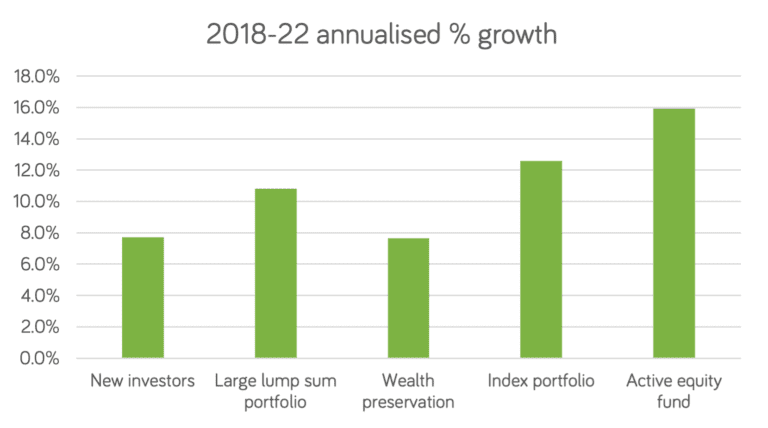

Dealing with volatility in your investment portfolio

Is the stock market getting more volatile? Or does it just seem that way? And what should you do about it? There’s no doubt the 2020s have been chock-full of shocks so far. We might have hoped for a roaring twenties… in fact we’ve had pandemics, war, and shortages driving inflation. For sure, the world … Continued

You must be logged in to post a comment.