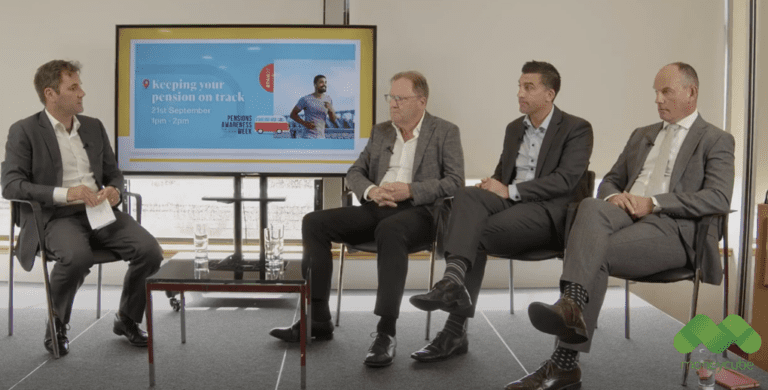

Moneycube Talks: Keeping your pension on track with Davy and Zurich Life

This year, it’s been impossible to ignore the markets. Driven by inflation, war supply chain shortages, there have been significant declines in most markets, followed by a partial recovery over the summer, which itself is unwound in September and October. Many of us have seen significant declines in the value of our pension pots. Whether it’s … Continued

You must be logged in to post a comment.