I’m investing a lump sum over the next few months, and want to keep things fairly simple. At the same time, I’m aware there’s a need to avoid putting all my eggs in one basket, and to spread my risk instead. Is one investment fund enough? Or how many investment funds should I hold?

Choosing whether to invest in a single fund or several is about finding a balance that’s right for your requirements. One hand, there’s a need to spread your risk among many different assets.

On the other hand, owning many funds can create unnecessary complication in your investments and pensions, and needs to be done right to make a real difference to your returns and your financial resilience.

There are several ways to achieve the balance that’s right for you.

The two-fund solution

To begin with, it’s worth pointing out that most investment funds are already highly diversified. Typically they will invest in tens or even hundreds of underlying assets. So, for example, if you have a high appetite for risk-reward, a single equity fund may do the job for you.

Alternatively, choosing two funds – an equity fund and a bond fund – could fit the bill, because you can simply adjust the amount allocated between each fund over time, to suit different risk appetites.

The multi-asset solution is even easier

These days, it’s easy to have a fund manager make these adjustments for you.

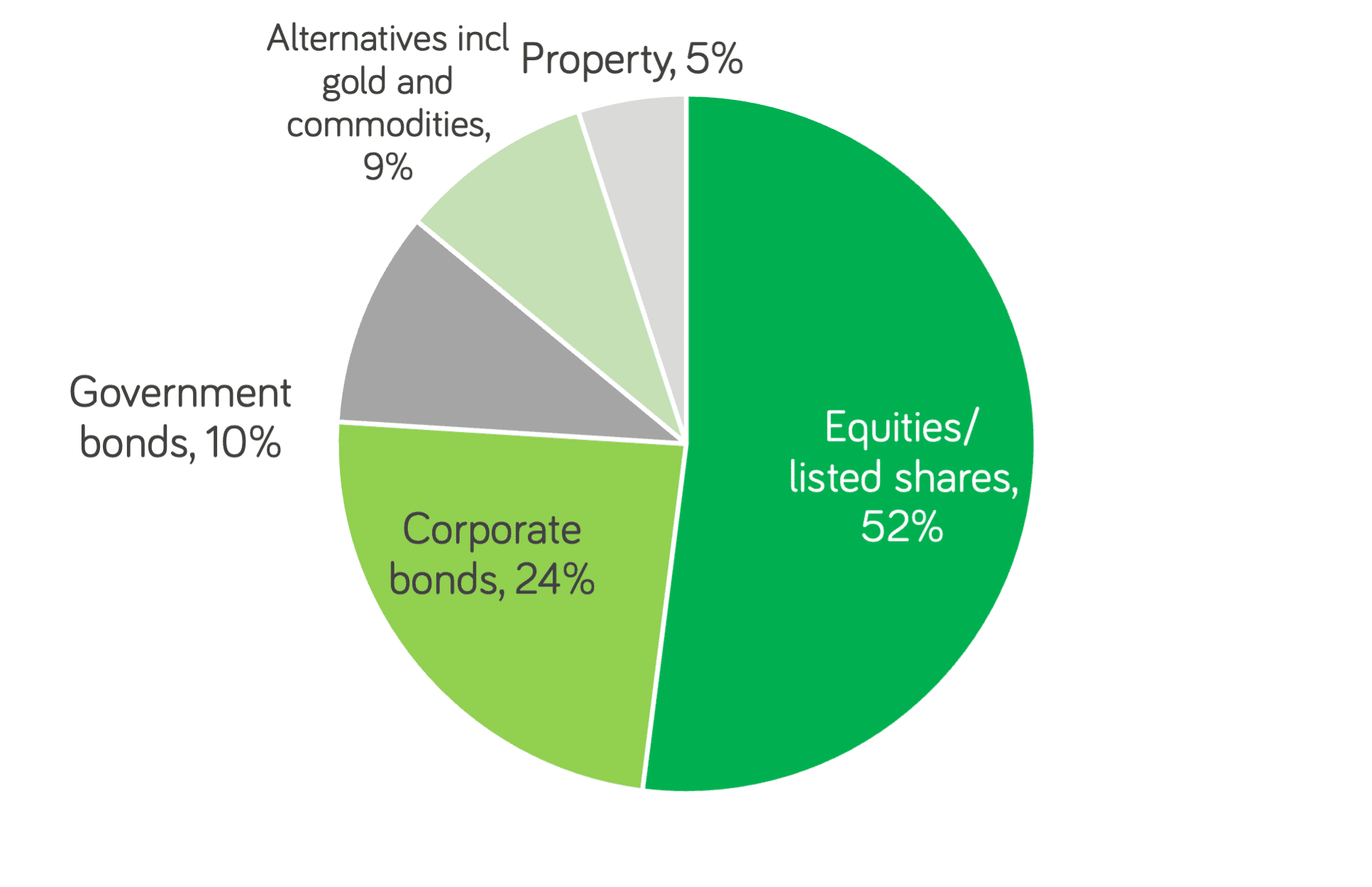

The simplest solution is to invest into a multi-asset fund. These funds aim to be a single solution for your investment needs, but holding numerous kinds of investments, all in a single fund. Here’s the investment split of one popular fund in Ireland, Zurich Life’s Prisma 4.

Data as at 30 April 2022

It may seem that a fund like this creates a large dependency on a single investment manager. In reality however, most multi-asset funds are run by teams of managers, in a fairly consensual way.

This has two implications for your decision on how many investment funds to hold:

- You will rarely find a fund like this taking an extreme position – for example, holding a major exposure to a niche sector. If that is what you’re looking for, you’ll need a second investment fund, as explained below.

- There is limited advantage in holding several multi-asset funds. This is because there will be a high degree of crossover in the underlying holdings. Most, for instance, will hold core positions in major companies of the world such as Microsoft, Bank of America, and Johnson and Johnson.

There are many multi-asset funds to choose among, from very stable performers, to those aiming to deliver high returns over time. Moneycube can guide you through them for your investment or pension.

Investing directly into funds gives you more control

Some investors, however, will want more control and scope to specialise. And there’s no doubt that holding more investment funds can diversify away from some risks. For example, you’ll reduce your exposure to any single investment manager or style.

And you can also introduce some niche exposures – whether to single industries, such as tech or healthcare, or to investment themes, such as ethical funds, or commodities.

For a fund of €100,000 or more, it’s possible to build a portfolio holding five, ten or even more funds, and maybe shares in listed companies too.

How many investment funds you choose to hold is of course open-ended. In general we find that once a portfolio has much more than 15-20 holdings, the benefits of diversification diminish, and it becomes difficult on a practical level to keep up with changes in the portfolio.

How should you choose how many investment funds to invest in?

Remember, how many investment funds you have in your investment portfolio or your pension is only part of the question.

What’s vital is the quality of those funds and the role they play in increasing, and protecting, your wealth.

If the funds are poor performers, or not in line with your investment timescale and aims, it doesn’t matter how many investment funds you hold.

Moneycube can help you navigate a universe of more than 4,000 investment funds to choose what’s appropriate for your requirements.

You must be logged in to post a comment.