How long will my pension last?

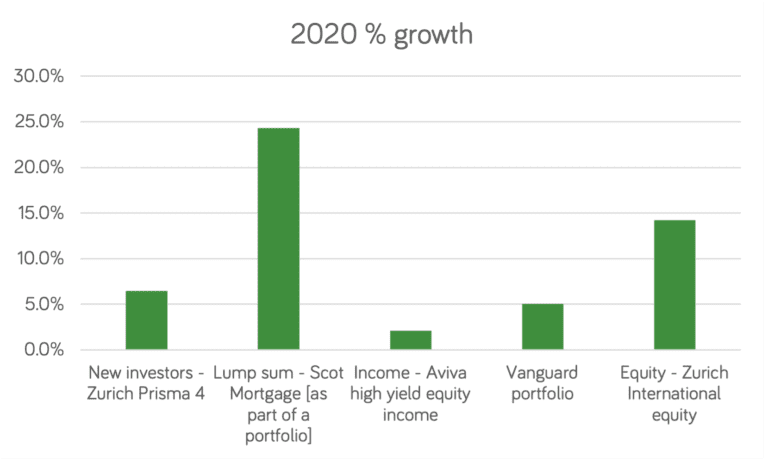

It’s the only question that really matters when it comes to your pension. Here, we explore the four factors that determine how long your pension will last. 1. How much is in the pot? It’s the natural starting point. How much have you saved up to now – and by how much has it grown? … Continued

You must be logged in to post a comment.