Edit Content

Get in touch with us at [email protected] or call 01 699 1110

Get in touch with us at [email protected] or call 01 699 1110

Jan 2025 update: Our more recent post highlights the best investment opportunities for your money in 2025. Welcome to Moneycube’s annual roundup of the best investments available in Ireland. We’ve chosen five funds we think have strong potential for as

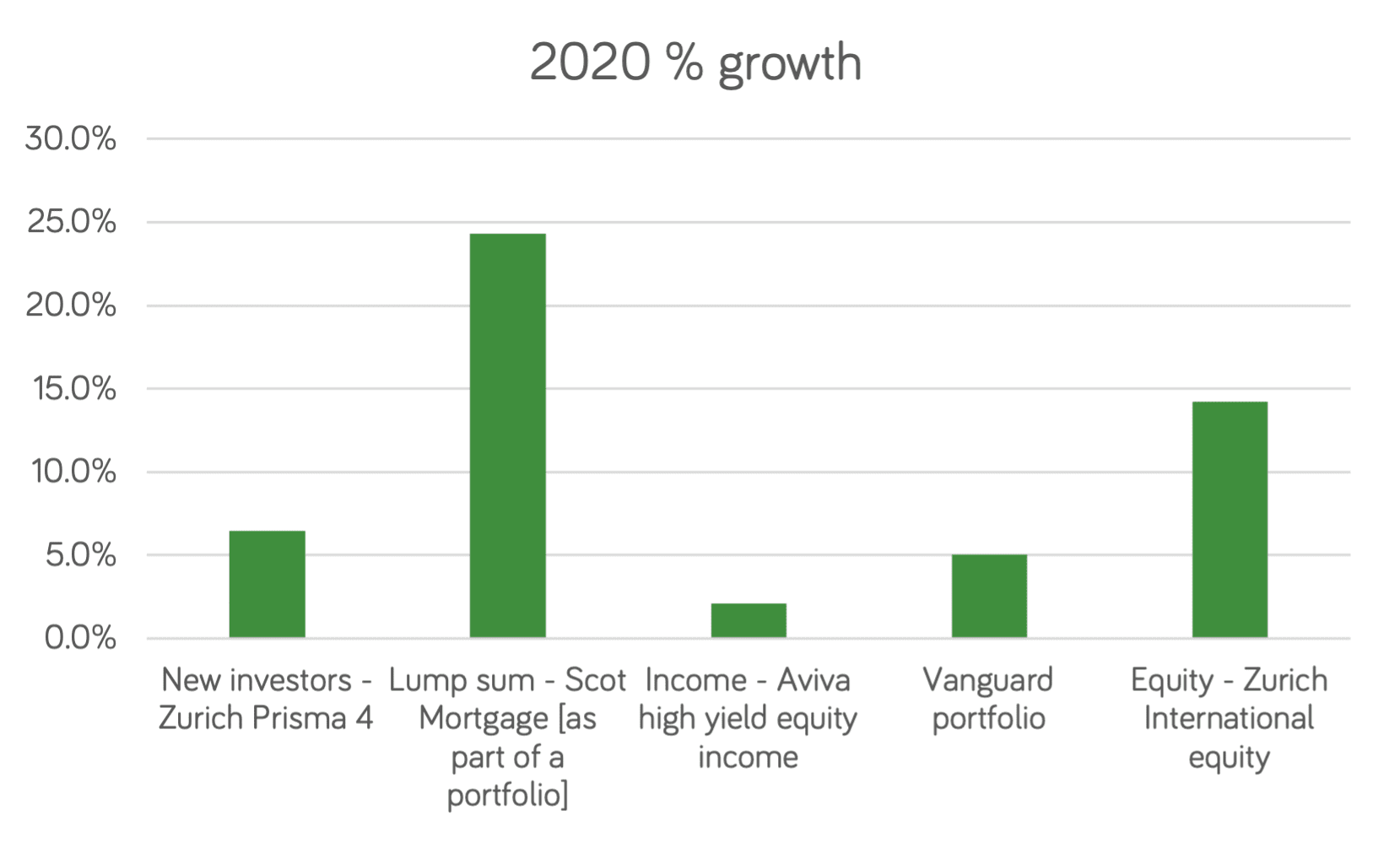

Each year, we pick a handful of investment funds available to Irish investors and highlight them on our blog. We’ve charted below how our 2020 selections performed. Interested in our 2023 picks? Click here to read more. There’s no doubt

Pension consolidation simply means combining all – or most – of your pensions with a single provider. Collecting a bunch of pensions from old jobs is increasingly common. In fact, US data suggests people these days will have had ten

One of the biggest advantages of combining your pensions is the ability to choose investments that are right from you. With over 4,000 investment funds at our fingertips, we can almost certainly help you invest in the way you want.

Consolidating your pensions isn’t a black-and-white decision – that’s why Moneycube provides financial advice on it! However, there are many solid reasons why combining pensions from jobs you have left is worthwhile. We’ve outlined them below: Keeping track of your

Whisper it: despite all the hype, not much has changed. Post-Brexit, if your pensions and investments in Ireland are well-managed, you should see very little change. Now officially, Brexit happened back in January 2020. But in practice, everything rolled over

Enter you email to subscribe to our newsletter

Enter your email address to get access to the latest news and updates from Moneycube

Warning:

Past performance is not a reliable guide to future performance. The value of your investments can go down as well as up and you may lose some or all of the money you invest. Investments denominated in a currency other than your base currency may be affected by changes in currency exchange rates.

Moneycube for

Moneybox Financial Ltd, trading as Moneycube, is regulated by the Central Bank of Ireland. Registered in Ireland, company registration number 572680. Registered office: 68 Harcourt Street, Dublin 2.

©2026 Moneycube. All rights reserved. Privacy policy | Cookie policy | Terms of business