Capital protected investments: just say no

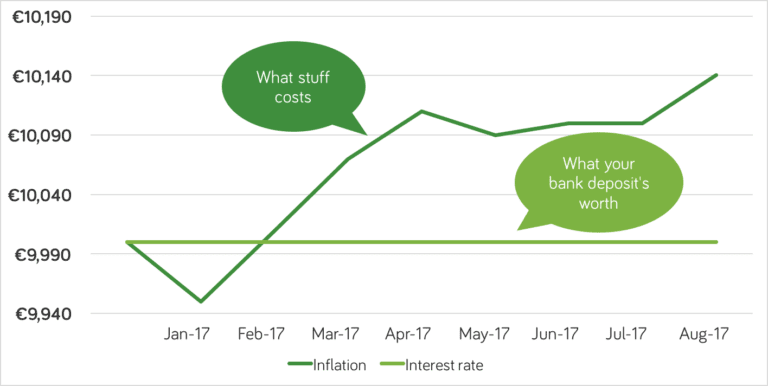

Lots of investors in Ireland are advised by Irish brokers to put their money into capital protected investments. At Moneycube, we believe these investments aren’t right for most people. Capital protected investments (also sold as kick-out bonds, tracker-bonds and guaranteed structured products) are sometimes presented as a one-way bet. You might think your capital is guaranteed, … Continued