July inflation numbers are out, and for the canny saver, it could be worse. With the summer sales, prices remained flat.

But it’s a strange world where watching your money tread water is a good result. At Moneycube, we believe more people should think about investing their savings for growth.

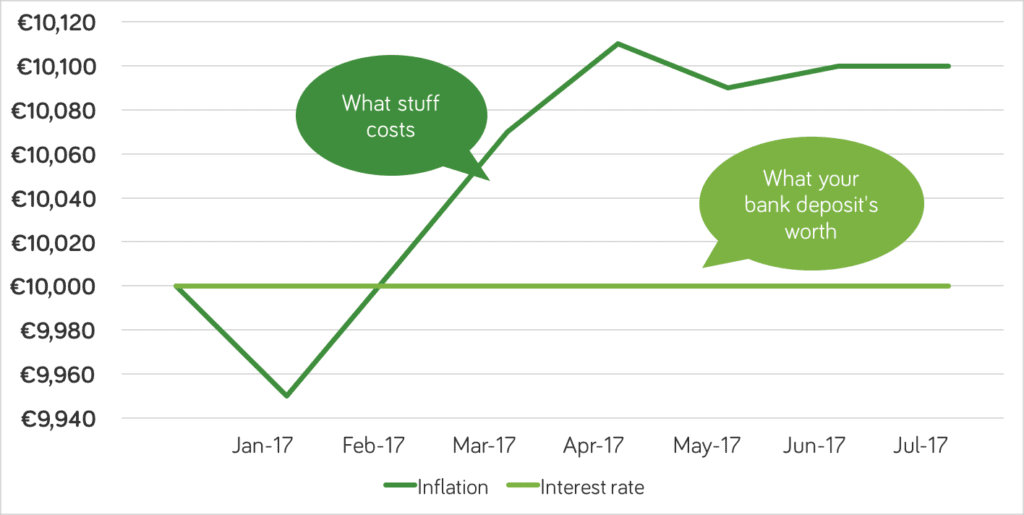

One big reason for that is that it is almost impossible now to make any money by leaving it on deposit in the bank.

And things are getting worse. So far this year, AIB, EBS, KBC, Bank of Ireland and Ulster Bank have all cut the interest they pay on deposit accounts, according to bonkers.ie.

On top of that, the best payer, the (weirdly named) Nationwide UK Ireland, has pulled out of the market.

Deposit rates are near-zero levels.

And so is inflation, according to the July inflation figures from the Consumer Price Index.

Zero percent? The sounds like my bank account

Really? Yep – it’s sales season. Clothing and footwear prices were down 6.7% compared to June.

And it seems the cost of buying a car is also on the way down, with car prices down 0.4% in the month, and 3.6% in the last year, according to the Central Statistics Office (CSO).

Mind your house

But it mightn’t feel so sunny when housing costs are counted. Private rental costs are showing up 7.3% in the year.

And while the Consumer Price Index doesn’t track housing (just rents and mortgages), separate info from the CSO last week showed an annual rise of 11.6% in the year to June. In the south-east of the country, rises of 16.7% were recorded!

The Moneycube inflation eater shows the impact inflation is having on your savings. It’s updated each month, once the Consumer Price Index is published by the CSO.

Tired of watching inflation eat into your savings? Get started with Moneycube today