Edit Content

Get in touch with us at [email protected] or call 01 699 1110

Get in touch with us at [email protected] or call 01 699 1110

My husband and I bought a flat in Dublin in 2007. When we had a family, we outgrew the flat and rented it out. We’ve been accidental landlords ever since. In recent years, the value of the property has finally

Welcome to Moneycube’s annual roundup of the best investments available in Ireland. Jan 2025 update: Our more recent post highlights the best investment opportunities for your money in 2025. We’ve chosen five funds we think have strong potential for the

It’s been a bad year for my investments. I hold several investment funds and some individual stocks. Overall I’m down more than ten percent. 2023 seems as uncertain as what has gone before. Should I sell my investments, adjust or

2022 has had an impact on everyone’s finances. So whether you’re in recovery mode, or looking for new ways to maximise the extra cash you’re saving, we can help you get your finances into shape for the New Year. Take

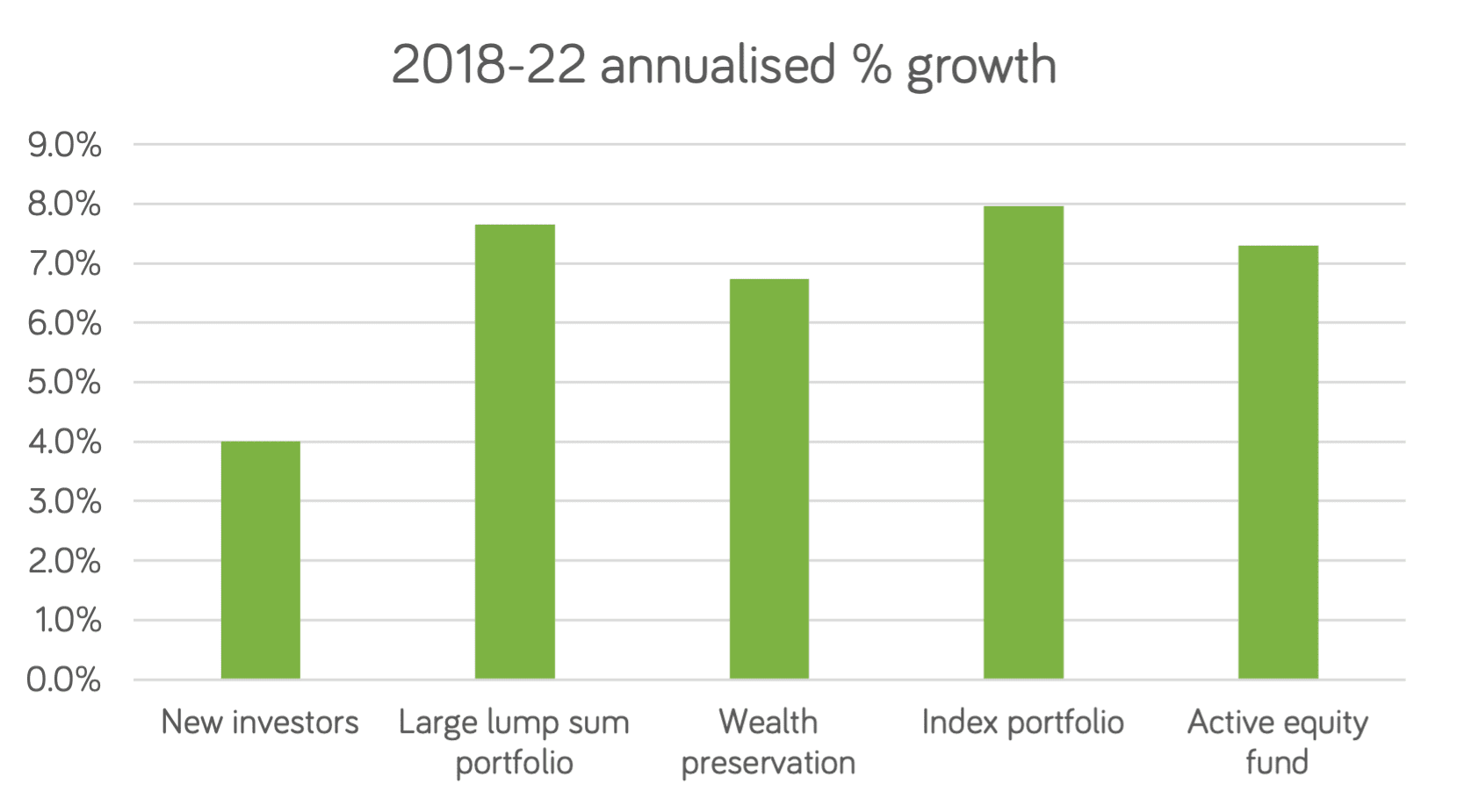

Each year, we pick a handful of investment funds available to Irish investors and highlight them on our blog. We’ve charted below how our 2022 selections performed. Interested in our 2023 picks? Click here to read more. There’s no doubt

2022 has been a year to forget for the vast majority of investors. And while the wider economy might look challenging in 2023, there are rays of light in investment markets, which have already priced in much of the downside.

Enter you email to subscribe to our newsletter

Enter your email address to get access to the latest news and updates from Moneycube

Warning:

Past performance is not a reliable guide to future performance. The value of your investments can go down as well as up and you may lose some or all of the money you invest. Investments denominated in a currency other than your base currency may be affected by changes in currency exchange rates.

Moneycube for

Moneybox Financial Ltd, trading as Moneycube, is regulated by the Central Bank of Ireland. Registered in Ireland, company registration number 572680. Registered office: 68 Harcourt Street, Dublin 2.

©2026 Moneycube. All rights reserved. Privacy policy | Cookie policy | Terms of business