Investors in the Friends First Irish Commercial Property Fund woke up to a nasty shock today. Aviva (which bought Friends First in 2018), announced that they had “taken the decision to move our property fund pricing from an acquisition to disposal basis”.

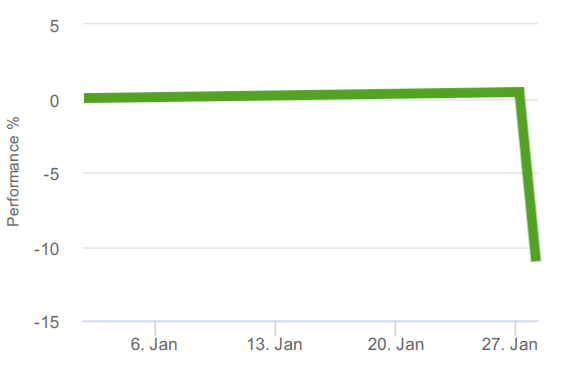

That all sounds pretty dull until you discover it means a drop in value of 9.1%!

What just happened?

Aviva is concerned about the amount of outflows from the fund – that is, investors asking for their money back.

On 31 December 2019, the fund held 4.6% of its value in cash, or around €28 million.

But if investors keep withdrawing from the fund, that cash pile could reduce further, meaning that Aviva wouldn’t be able to meet withdrawal requests.

And because most of the rest of the fund is property, that is a tough problem to fix. Property takes a long time to turn into cash – it’d typically take six months or more to liquidate many of these holdings, unless you’re willing to accept fire sale prices.

What happens next?

Aviva points out that this reduction in value will only be realised for investors who decide sell out while the fund is priced on a “selling basis”. If you sit tight, it’s possible that the value will rise just as dramatically when the fund is priced again on a “disposal basis”. But when will that be?

Adjusting the value so dramatically may well dissuade investors from selling their holdings and crystallising this drop in value. But it’s also possible that it will encourage more investors to head for the exit, to avoid the risk of further losses.

In a worst-case scenario, Aviva could be forced to ‘gate’ the fund.

That means that investors would be unable to sell their holdings in this fund for a period, giving the fund breathing space to build up cash, perhaps by selling properties. This recently happened in the UK, with the M&G Property Portfolio fund, with Brexit and difficult times in the retail sector cited as the reasons.

What should you do?

If you already have money in the Friends First Irish Commercial Property Fund, the impact of this change has already hit your fund value. The big question is whether to stay put, or sell now.

The argument for staying put is that the fund holds the same properties it did at the start of the week, and today’s change is only an accounting exercise, or an “an unrealised movement in value” as Aviva put it.

The fund grew by 8.7% last year, and by 7.2% over the last three years. If you believe Irish commercial property is the right place for your money, then this fund offers a representative selection.

It has a net asset value of over €600 million, owns 50 commercial buildings, mainly in central Dublin. Highlights include three retail buildings on St Stephen’s Green and the Disney store on Grafton Street. Outside the capital, Friends First’s fund owns retail parks in Naas, Kilkenny and Carlow.

It produces an annual rental yield of almost 5%, or €28.8 million. And more than 60% of its leases (by rent value) have at least five years to run. For an adventurous investor, today’s news might even represent a buying opportunity!

On the other hand, there is a risk of further falls in value, or even that withdrawals could be prevented for a period. And it’s clearly the case that a substantial number of investors have already decided to cash out in recent weeks.

What’s Moneycube’s view?

At Moneycube, we believe the cornerstone of most investors’ portfolios should be multi-asset funds, invested on a global basis. The focus of investment funds is generally company shares, which are highly liquid.

In contrast, the Friends First Irish Commercial Property Fund is focused on a single country (Ireland, and particularly Dublin), and a single asset class.

Today’s news is a reminder of the risks of investing into illiquid assets such as property (which can take months to turn into cash) in a fund where investors expect to be able to get their money back without notice.

At a minimum, today’s drop should prompt investors to review their investment mix – let us know if we can help.