Edit Content

Get in touch with us at [email protected] or call 01 699 1110

Get in touch with us at [email protected] or call 01 699 1110

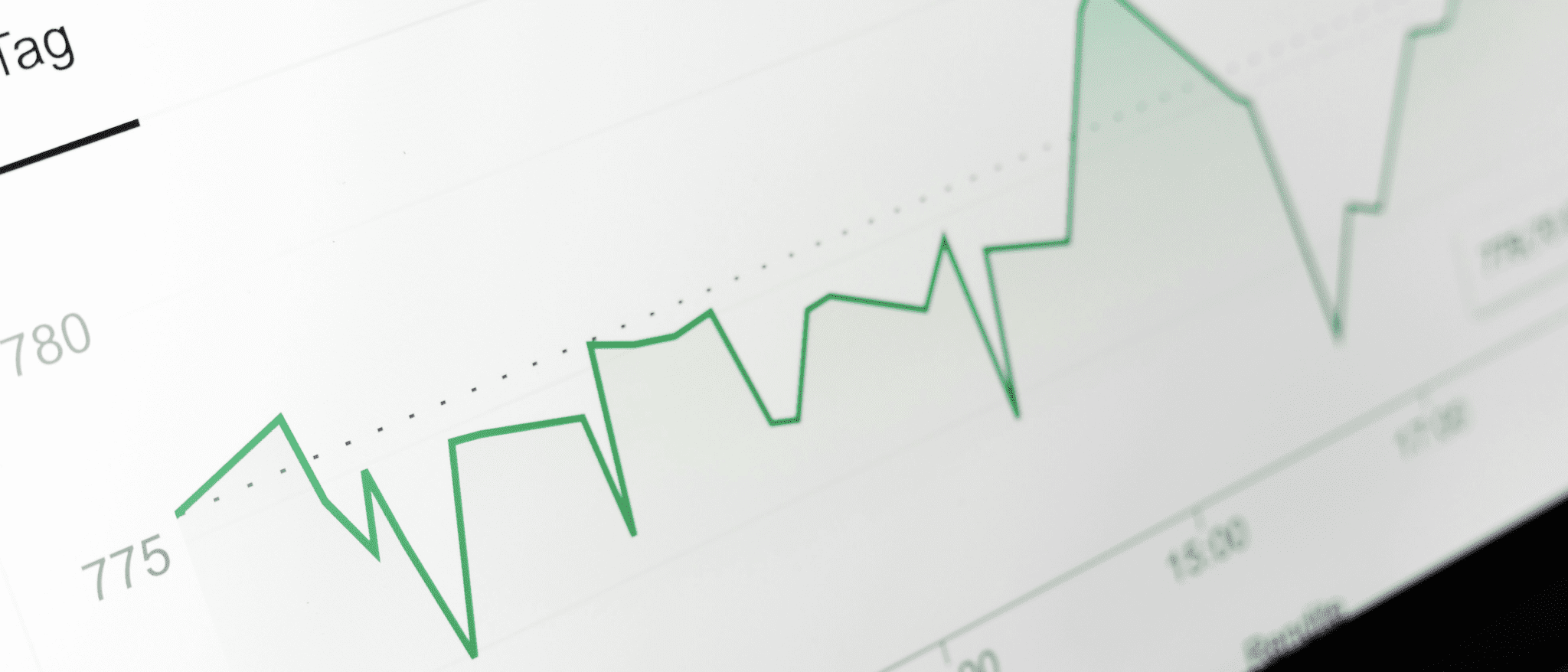

Interest rates have been the big story for Irish savers, borrowers, and investors over the past two years. After a rapid series of hikes from the European Central Bank (ECB) to tackle inflation, we’re now seeing the dial turn in

Since Revenue updated the rules around employer PRSA contributions at the start of this year, many businesses and company leaders are seeking clarity on how to implement them . In particular, how does the new 100% limit work – and

The world – and investment markets – can seem a volatile place right now. Global markets are adjusting to tariff announcements and reversals, changing interest rates, geopolitical tensions, and a shifting economic landscape. That’s unlikely to change anytime soon. In

When it comes to investing, it’s tempting to stick with what’s familiar — and in the world of global equities, the S&P 500 is about as familiar as it gets. But if your portfolio leans heavily towards this index, it

More than two weeks after so-called ‘Liberation Day’, markets continue to be eventful, with large movements in the price of major companies on any single day. This week, for example, saw anti-obesity drugmaker Eli Lilly’s shares rise over 15%, and

Markets make uncomfortable news at the moment. Certainty is low, and volatility is high. And there are likely several chapters in the US tariffs story to follow. What should investors do based on their current holdings? And how can we

Enter you email to subscribe to our newsletter

Enter your email address to get access to the latest news and updates from Moneycube

Warning:

Past performance is not a reliable guide to future performance. The value of your investments can go down as well as up and you may lose some or all of the money you invest. Investments denominated in a currency other than your base currency may be affected by changes in currency exchange rates.

Moneycube for

Moneybox Financial Ltd, trading as Moneycube, is regulated by the Central Bank of Ireland. Registered in Ireland, company registration number 572680. Registered office: 68 Harcourt Street, Dublin 2.

©2026 Moneycube. All rights reserved. Privacy policy | Cookie policy | Terms of business