Best place to invest money in Ireland in 2025

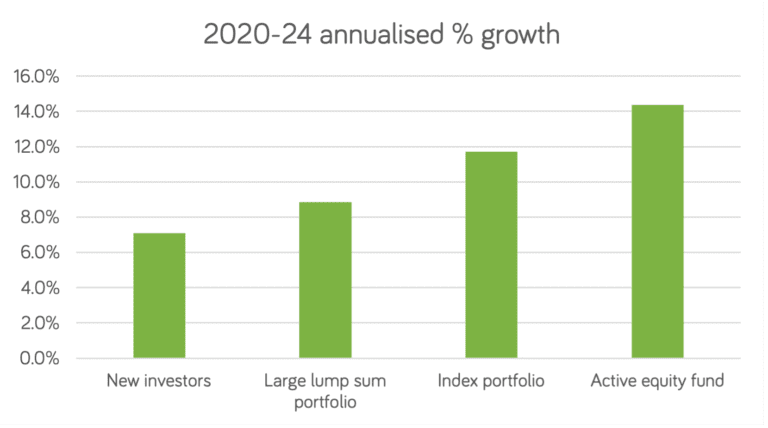

Welcome to Moneycube’s annual roundup of the best investments available in Ireland. We’ve chosen five funds we think have strong potential for the year ahead in the wake of a prosperous 2024. If you’re looking to invest money in Ireland, read on. Whether you’re a new investor, or looking to invest a large lump sum, we’ve … Continued

You must be logged in to post a comment.