Is the stock market getting more volatile? Or does it just seem that way? And what should you do about it?

There’s no doubt the 2020s have been chock-full of shocks so far. We might have hoped for a roaring twenties… in fact we’ve had pandemics, war, and shortages driving inflation. For sure, the world is a volatile place right now. And it’s easy to imagine risks that can threaten your wealth.

Put volatility in perspective

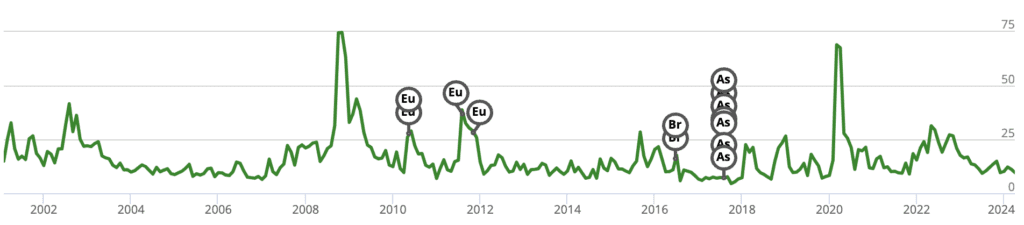

In financial terms, a look at volatility in the past should settle nerves a little. Take a look at this chart.

This chart shows of the best measures of historic volatility, the Cboe Realized Volatility Index, since the turn of the century. (It’s produced by the Chicago Board Options Exchange, who also produce the Vix index, a well-known measure of market expectations for future volatility).

A couple of things are clear:

1. Today’s volatility is lower than at many times in the last quarter-century

2. Volatility has significantly reduced over the last two years

So why do markets seem so volatile?

There are several reasons why market shocks seem very real just now.

First, the wider world is suddenly a more dangerous place, with the middle east at its most threatening in decades, Russia at war with Ukraine, rising threats from climate change, increasing global migration and so forth. But in pure financial terms, these changes are driving economic activity as well as risk.

Secondly, we have a natural tendency to forget yesterday’s worries. But in their time the war on terror, the global financial crisis and the Arab spring, to name only a few, were major changes that caused investors to hesitate and worry about risk.

And thirdly, big companies are getting bigger. That can lead to some dramatic news stories.

Here’s one from earlier this week, for example:

Nvidia plunged 10%, wiping out $212bn (€200bn) in market value

Percentages of big numbers are themselves big numbers. Take a look at Apple. In 2018, Apple’s value surpassed $1 trillion. Five years later, it surpassed $3 trillion.

So when its share price slipped 4% last month, it lost over $100 billion in market value. Painful – but not in itself critical. Plenty of listed businesses experience percentage rises and falls of this scale from time-to-time.

Making sense of volatility

Big market moves can seem dramatic – and risky. But in fact volatility is not the same as investment risk.

Volatility is a mathematical measure of how much an investment goes up and down over time. Such ups and downs can look risky. For sure, if you need to sell your investment in a hurry, it can be a problem, as you might be forced to sell in a market dip.

But to the long-term investor, short-term volatility is of little concern. It can even mean an opportunity for better returns over time.

True investment risk, on the other hand, is composed of many factors. Ultimately, it boils down to the likelihood that you may suffer a permanent loss of capital by placing your money in an asset which is worth less than you paid for it when you want to sell.

So what can you do to manage volatility in your investments?

The first step is psychological. To invest your money (rather than staying in pure cash), is to accept that investments go up and down. Over the longer term, there are many decades of data to show that risk assets outperform the risk-free rate – that is, the interest you can get on cash. Make peace with those facts.

The second is practical. The are simplest step you can take to manage volatility when investing your money is to do so gradually.

For example, you can drip-feed a lump sum over several weeks or months, build it via a regular monthly investment (also known as cost-averaging), or move from lower-volatilty assets into higher-volatility exposures in a gradual way.

Finally, your choice of investment assets makes a big difference.

Using investment funds rather than investing directly into single assets (whether shares, property or anything else) helps limit your exposure to the performance of any single investment. Investment funds come in many shapes and sizes. They often hold hundreds or even thousands of underlying positions. They may own different kinds of assets within a single fund (bonds and equities for example). And funds can use strategies to limit volatility within the fund. They may, for example, insure themselves against falling share prices by buying put options in the open market. Or they may hedge certain exposures, such as currency risk, by paying a counterparty to bear the risk.

Volatility can be managed

Volatility – and investment risk – is out there, and there is no room for complacency. But looked at over a long-term perspective, today’s volatility levels are not out of the ordinary, and with some well-understood approaches – whether psychological or practical, there is a way to manage it for successful long-term investment outcomes.

You must be logged in to post a comment.