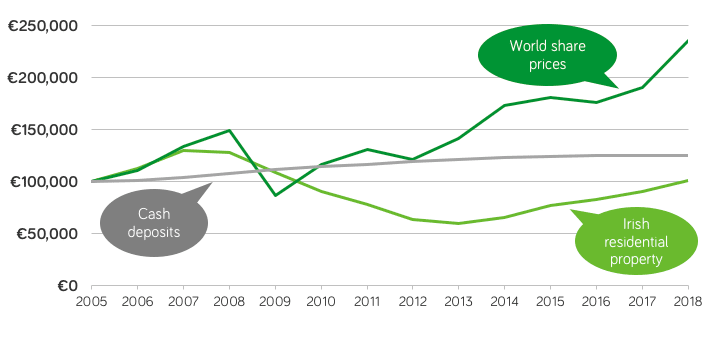

Property and bank deposits are favourite investment classes for Irish people, but how do these investments compare with company shares? Moneycube has investigated the returns of each asset class since 2005.

As the chart shows, investing in global stock markets at the start of 2005 would have produced by far the largest return.

A notional €100,000 invested in 2005 in world stock markets would have been worth over €235,000 at the end of 2017. Nice.

While Irish property has recovered strongly in recent years, it is only now reaching 2005 levels, and has some distance to go before reaching the highs of 2008. The same €100,000 invested in Irish property would have been worth around €100,400 by the end of last year.

Cash, meanwhile, preserved its value during the financial crisis when shares and property took a battering. But it has returned almost nothing in interest since the financial crisis. Over the long run, investing in the stock market has comfortably outstripped cash.

Show me the numbers

We’ve taken as starting point of January 2005 to make this chart. That’s when the Central Statistics Office started compiling its residential house price index.

We’ve compared that with interest rates for notice deposit accounts from the Central Bank of Ireland, and the MSCI All Country World Index for share prices.

Health warnings

As you’d expect, we’ve made a number of assumptions in order to make this comparison. Here’s the small print.

We have ignored rental income from investment property, as well as dividend income from shares. The MSCI All Country World Index is denominated in US dollars.

We’ve also ignored the transaction costs of investing in and managing property and in shares, as well as taxes, all of which can reduce returns.

The moral of the story?

Over the last 13 years, global shares have clearly outstripped investing in Irish residential property, or leaving your money in cash.

Of course everyone’s circumstances are different. Considering the different investment results from cash, shares and property, there’s a clear advantage for many people to invest at least some of their wealth in the global stock market.

Talk to Moneycube today about how we can help with that.