At Moneycube we believe more people should think about investing their savings.

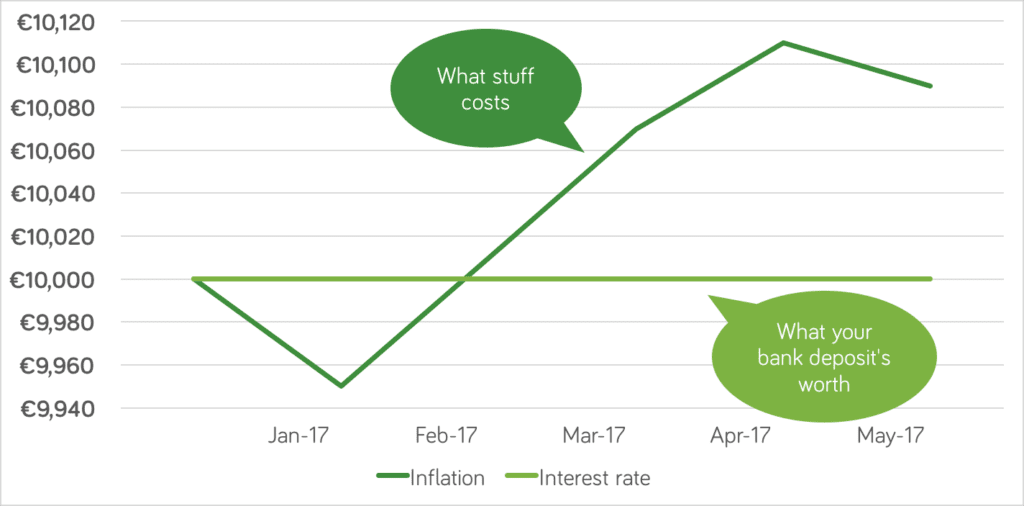

One big reason for that is that it is almost impossible now to make any money by leaving it on deposit in the bank. Deposit rates continue at near-zero levels.

Prices came down in May

While your bank savings might have gone nowhere in May, there was good news for the inflation eater, with prices easing off. A lot of the good news came from cheaper transport costs. Car insurance finally started coming down a little, while diesel and petrol as well as air fares fell.

But compared to the start of the year, inflation is up nearly 1%. That means your savings still have plenty of catchup up to do.

What’s the inflation eater?

The Moneycube inflation eater shows the impact inflation is having on your savings. It’s updated each month, once the Consumer Price Index is published by the Central Statistics Office.

Tired of watching inflation eat into your savings? Get started with Moneycube today

Source