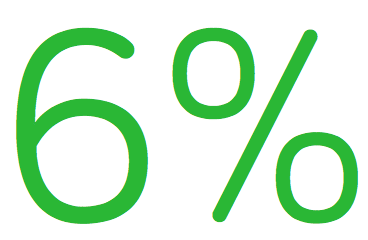

Time to take a halftime score on Irish listed companies. Looking at the ISEQ 20 index, it’s clear Irish shares had a good six months. The index is up 6% from the start of January.

In reality, this is thanks to the performance of a handful of companies. Just 6 companies make up nearly 80% of the value of the index. In fact, CRH and Ryanair alone make up two fifths of it!

The other big uns are Kerry Group, Paddy Power, Bank of Ireland and Smurfit Kappa.

Lifting the lid a little shows widely varying performances.

Who’s up?

Well, it helps that Ryanair – around a fifth of the index – has risen 24% in the period, with some analysts predicting more to come. Michael O’Leary was one of the beneficiaries – he cashed in around €72 million worth of shares at the start of last month. And he’s still one of the top shareholders in the company.

The other big winner was packaging business Smurfit Kappa, whose shares were up around 28% in the first six months as revenues and the dividend grew.

Kerry Group also had a good first half, up almost 11% as it reported continued growth.

Who’s down?

CRH, the buildings materials business, is the biggest presence in the ISEQ. It had a more mixed six months, falling around 2% in the period. That follows a rise of around 43% during 2016 however.

Paddy Power Betfair and Bank of Ireland were also marginally down over the six months.

Can I take a piece of the action?

Yes, it is possible to buy into the performance of the ISEQ20 – this Exchange Traded Fund (ETF) is designed to track the index. As an ETF, it has a fairly reasonable expense ratio of 0.49%.

In reality, however, a bet on the ISEQ is not really a bet on the Irish economy – it’s a bet on a handful of Irish success stories, almost all of which are generating most of their earnings internationally.

Get started with Moneycube today