June inflation figures mean your money buys a little less this month.

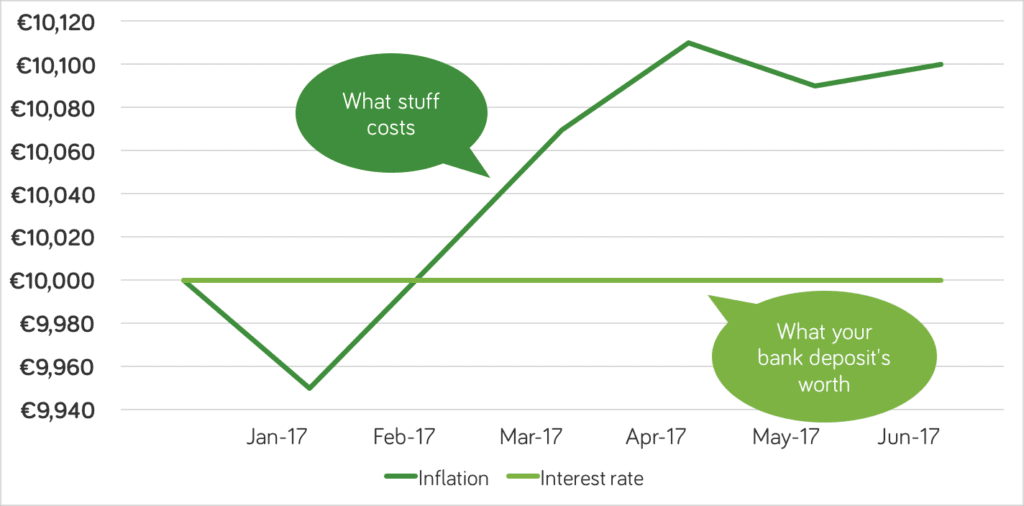

At Moneycube we believe more people should think about investing their savings for growth. One big reason for that is that it is almost impossible now to make any money by leaving it on deposit in the bank. Deposit rates continue at near-zero levels, while prices creep up.

Prices went up in June

While your bank savings didn’t go anywhere in the month of June, inflation ate away at your spending power.

While prices have fallen 0.4% in the last 12 months, they rose 0.1% during June.

Different cost rises vary though. Good news this month if you’re into clothes shopping, with prices going down 2.8% compared to May as the summer sales kick in.

Comparing those numbers to last year will give you even more amusement. Compared to June 2016, shoe and clothes prices are down a chunky 5.3%.

Rough news, on the other hand, if you’re a big restaurant and hotel spender, with prices up 1.2% last month.

Housing is the biggie

Housing and utility bills also went the wrong way last month, going up 0.5%.

The big one here is private rental costs, up 0.8% in June, and 7.9% in the last 12 months.

Separate data for house sale prices recently showed an average increase of 11.9% across the country in the year to May. No savings account is going to match that.

Inflation is up since the start of the year so unless you found the black swan of banks, it looks like your cash savings have lost 1% of their buying power in the first 6 months of 2017.

What’s the June inflation eater?

The Moneycube inflation eater shows the impact inflation is having on your savings. It’s updated each month, once the Consumer Price Index is published by the Central Statistics Office.

Tired of watching inflation eat into your savings? Get started with Moneycube today

Source: CSO