2026 is shaping up as a year which will reward a more sophisticated approach than simply buying the global stock index. The narratives of 2025 – AI acceleration, global interest rate cuts and tariff hokey cokey – are giving way to picking winners and losers, regional divergence and opportunities beyond the stock and bond indexes.

Here are five drivers to watch in markets in 2026.

1. AI: boom, bubble – or both?

Artificial intelligence remains one of the most transformative trends of our times. Yet the rapid surge in AI-linked stock prices and investments has also fuelled debate over whether the theme has entered a valuation bubble.

Some argue that current prices reflect genuine long-term growth potential. Others warn that the massive capital spending on AI infrastructure will struggle to generate meaningful returns and that we are in a time of speculative excess. Opinions on this divide are deeply split.

A striking example of this tension is the boom in data centres – a sector where Ireland has more exposure than most.

In 2025, more and more of these projects where financed through raising debt, where previously they were built using cash from the profits of large players. If some of this activity winds up as ‘white elephant’ infrastructure, the lenders to these projects will feel pain.

In 2026, the market is likely to differentiate more sharply among AI players, yielding clearer winners and losers. Businesses with sustainable AI earnings and technology leads, as well as those who can us AI to drive profits in their business will benefit.

That could generate some surprises. Alphabet, for example, whose Google search dominance had seemed under threat of replacement, may turn the tables with the launch of Gemini 3, using in-house chips – some influential people are impressed. That could in turn put pressure on the demanding valuations of Nvidia and other winners in the AI race over the last couple of years.

Others who have done well from the optimism surrounding AI but don’t deliver on targets are likely to come under scrutiny. The recent correction in Oracle’s share price, down around 14% following its results announcement on 10 December, is an indicator of what could happen more widely next year.

2. Global rate-cutting looks to be over

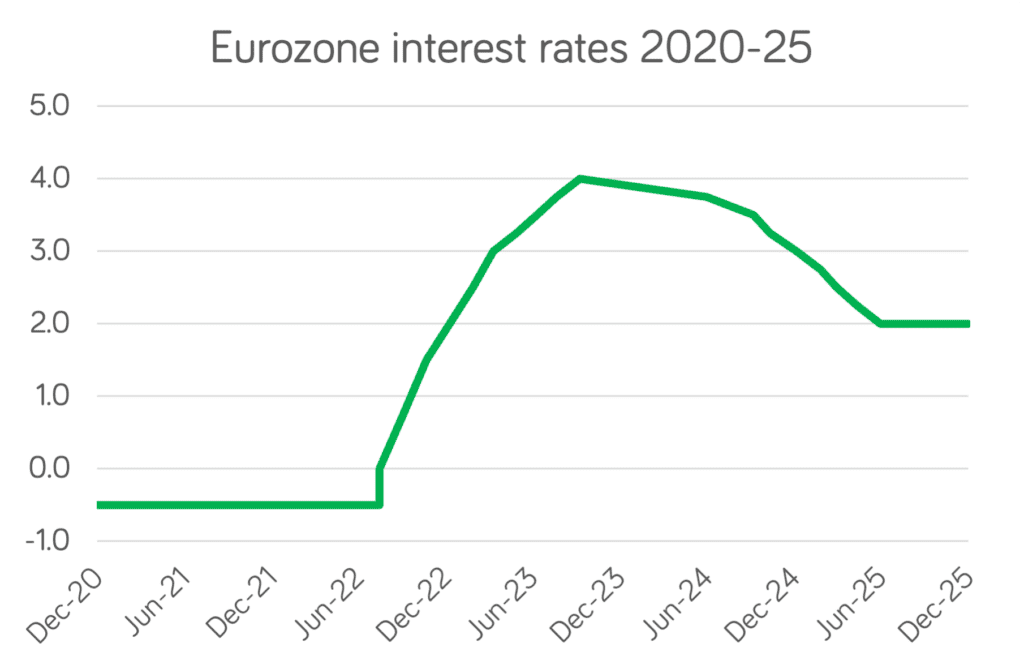

From aggressive cutting in the pandemic to large rises from 2022 onwards, interest rates have been a driving force in markets in the first half of the decade. In 2025, Eurozone interest rates fell from 3% to 2%.

We see greater stability from here. The global easing cycle looks to be over, with policymakers signalling less radical moves from here and the potential for future hikes if some countries.

The wild card here is the US, where the Federal Reserve governor is due to be replaced next year. The Fed was under sustained pressure from the Trump administration to cut rates in 2025. A Trump-friendly appointee would likely be more amenable to looser policy, and a key effect from this would be to devalue the US dollar further compared to other countries.

That will affect bond and stock investment choices for Europe-based investors – the home market will be more attractive. It also likely means that momentum from rate cuts will be less important, and investors will increasingly look for earnings growth to justify valuations.

3. Europe: structural opportunities rise

Europe’s investment appeal has long lagged behind the US, particularly in its ability to grow dominant technology businesses. But geopolitics, stretch valuations in the US, and structural change could give Europe a leading role in 2026.

Geopolitical tensions and supply chain vulnerabilities have elevated defence budgets, while energy transition goals and resilience planning are directing capital toward infrastructure projects.

In particular, Germany is still getting into its stride in putting into action the infrastructure and defence spending plans it announced this year.

The sums are enormous. There’s €500 billion for infrastructure, including transport, housing, education facilities, digital infrastructure and climate protection. In addition debt ceilings have been raised to enable federal and state governments to borrow to invest in defence and other capabilities. It’s estimated this could add between 0.7 and 1.5 per cent per year to the German economy for a decade.

Additionally the longed-for prospect of peace in Ukraine, and the reconstruction activity it would prompt, could provide a fillip for European markets in 2026.

4. Emerging markets: currency tailwinds and China’s rebound

Emerging markets often struggle under dollar strength and liquidity tightening. In 2026, that dynamic seems likely to reverse.

A softening or stabilising US dollar can ease currency pressures on emerging economies, reducing external debt servicing costs.

China remains central to the emerging markets story. Goldman Sachs are particularly optimistic, forecasting China’s economy to grow 4.8% next year due to resilient exports and manufacturing competitiveness gains. The bank’s view places China’s GDP growth well above consensus, supported by a focus on manufacturing and export market levels.

The Chinese economy is becoming more sophisticated too, focusing more on advanced manufacturing in its new Five Year Plan, and working out some of the property-led downturn which has restrained it in recent years.

But there are many other areas in emerging markets which look interesting as 2026 dawns – from relatively low valuations in Latin America to India’s favourable demographics and the Middle east’s move from oil towards more diversified economies

5. Alternatives can offer balance

Precious metals have performed strongly this year, and the conditions that created this run haven’t gone away. They include inflation fears, central bank buying, retail interest and industrial demand. In 2026, it looks worth casting the net wider.

For example, infrastructure and property assets could provide real returns as interest rates stabilise. Base metals could see continued demand as AI adoption grows. And other commodities could provide a useful way of hedging against a return of inflation.

More discriminating markets in 2026

Taken together, these themes suggest that in 2026 may reward clarity: who has real earnings growth, whose business model is proven, and where structural trends (such as state-driven capital investment, and less demanding valuations) provide a tailwind.

You must be logged in to post a comment.