The Irish government starts selling down your stake in AIB from 23 June. If you’ve got a spare €10,000 or more, you might be thinking of taking a slice (you need to be signed up with a stockbroker by Friday 16 June).

Here are five reasons we’re steering clear.

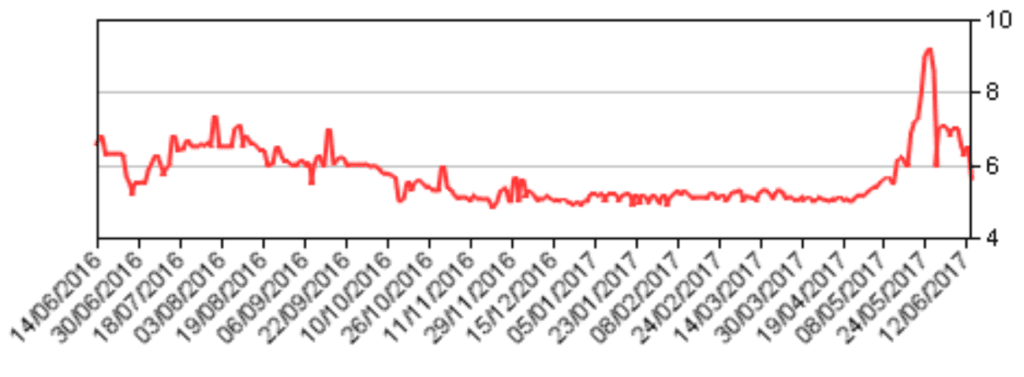

1. AIB’s share price is way down from a year ago

There’s been some elbow-barging over the last few weeks as rumours of the float got going. But the share price is now down around 17% on a year ago, despite all we hear about our booming economy. And as you can see in the chart, the share price has gone basically nowhere for most of 2017.

2. The business is not diverse

You are looking at a bank which is still highly dependent on Ireland, and on a property market which many people reckon is looking bubbly. 85% of AIB’s loans are in the Republic of Ireland. And 68% of its loans are mortgages or property or construction loans.

3. Does anyone know what’s really behind the balance sheet?

AIB still has baggage. We know there are still €9.1 billion worth of impaired loans (that’s loans you wouldn’t make on the same terms today), and that 22% of the loan book is classified as ‘non-performing’. AIB has made progress in improving these numbers but whether that can continue depends on lots of things beyond its control such as interest rates, economic performance, Brexit and the rest.

4. AIB’s core business looks vulnerable

Irish banks are increasingly at risk from Euro-wide competitors eating away at their retail customer base – think N26 – while their business customers have increasing options like Linked Finance.

The bank describes First Trust, its Northern Irish operation, as a “focussed challenger”. Really? In reality the challenger banks in Northern Ireland are the big UK challengers like Atom Bank, Monzo and Starling. AIB should know that: their old chief operating officer, Anne Boden, now runs Starling!

5. We’ll still own a big chunk of it anyway

Congratulations – the taxpayer will hold around 75% of the shares after the sell-off.

You can expect more bouncing round of the share price in the short term after 23 June. If you get in and get out at the right time, you might collect a rapid return. But if you’re trying to build up your money in a steady planned way, there are probably more appropriate homes for that cash.

Owning AIB for the guts of a decade has been long enough for most of us. From Moneycube’s perspective owning shares in AIB looks like the wrong place to put our money.

Sources:

Irish Stock Exchange (for share price chart)

Financial numbers quoted are as at 31 Dec 2016 unless otherwise stated

Get started with Moneycube today